Caterpillar Tops Estimates as Sales Soar on Energy Equipment

PositiveFinancial Markets

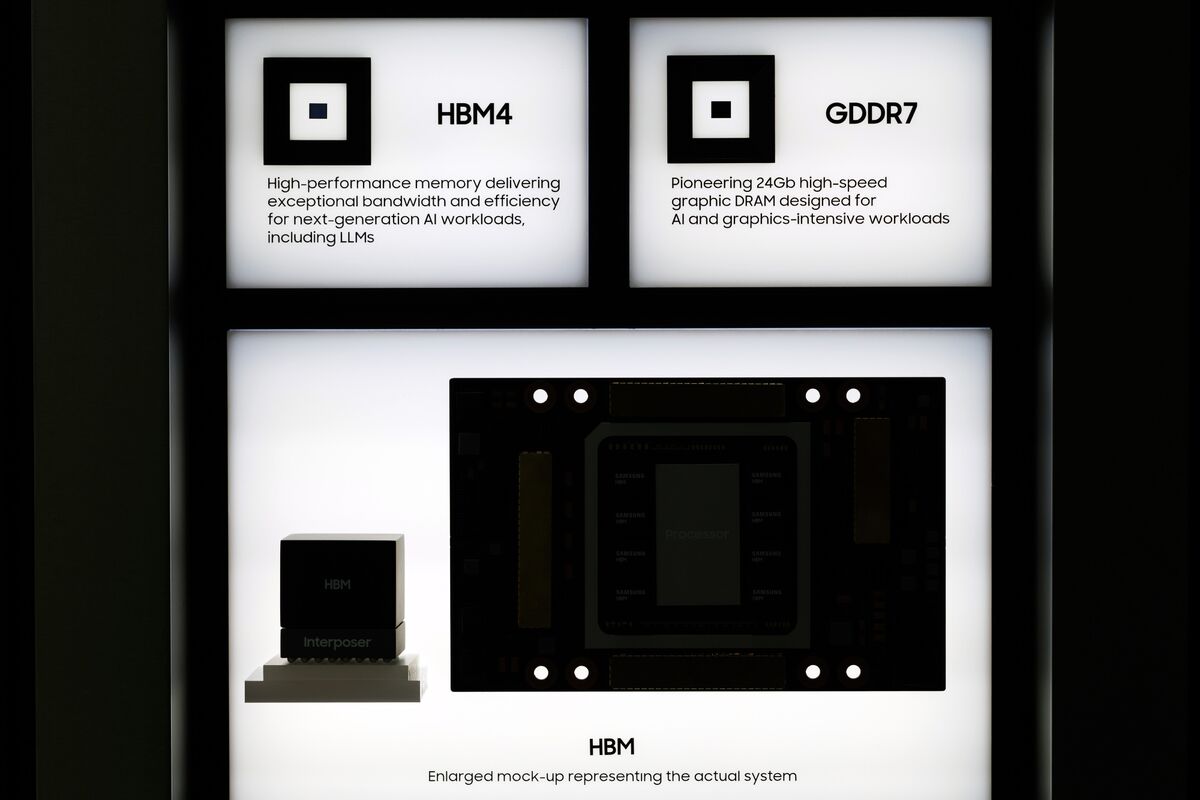

Caterpillar Inc. has exceeded expectations with its third-quarter revenue, driven by a surge in demand for energy and transportation equipment, particularly for data centers supporting artificial intelligence. This growth highlights the company's strong position in a rapidly evolving market, showcasing its ability to adapt and thrive amidst technological advancements.

— Curated by the World Pulse Now AI Editorial System