Treasuries, Volatility Rise as Anxiety Grows Before Jobs Numbers

PositiveFinancial Markets

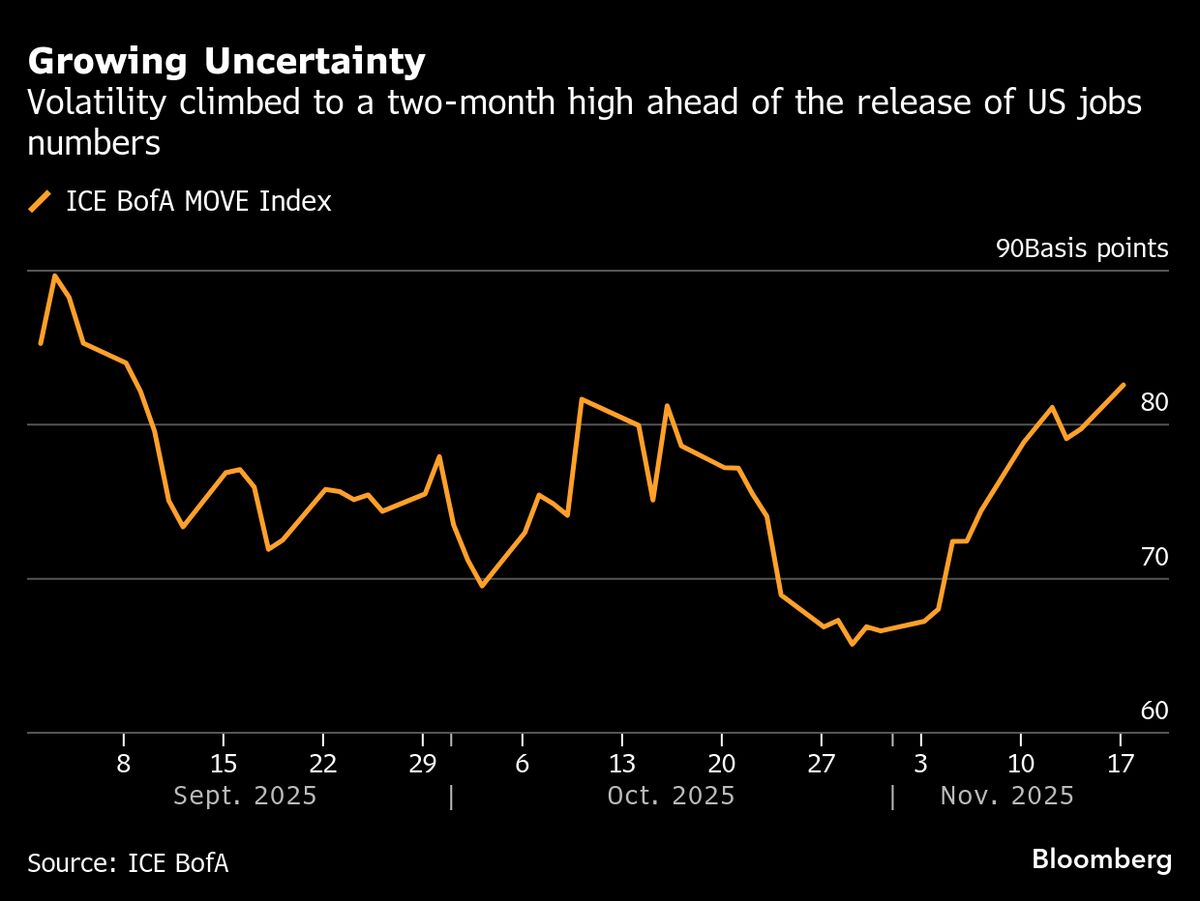

- Treasuries are on track for back-to-back gains as traders anticipate more Federal Reserve interest rate cuts, driven by anxiety over upcoming jobs numbers from ADP Research. This reflects a cautious market sentiment as investors prepare for potential shifts in economic indicators.

- The Federal Reserve's decisions are pivotal in shaping market dynamics, especially as they navigate the complexities of liquidity management amid fluctuating investor confidence. The anticipation of jobs data adds another layer of uncertainty to their policy-making process.

- The current market volatility underscores broader themes of investor sentiment and economic stability, with the Federal Reserve's balancing act becoming increasingly challenging. As optimism and caution coexist, the implications of employment data on financial markets remain a focal point for traders.

— via World Pulse Now AI Editorial System