Stock Futures, Bitcoin Trim Losses After Selloff: Markets Wrap

PositiveFinancial Markets

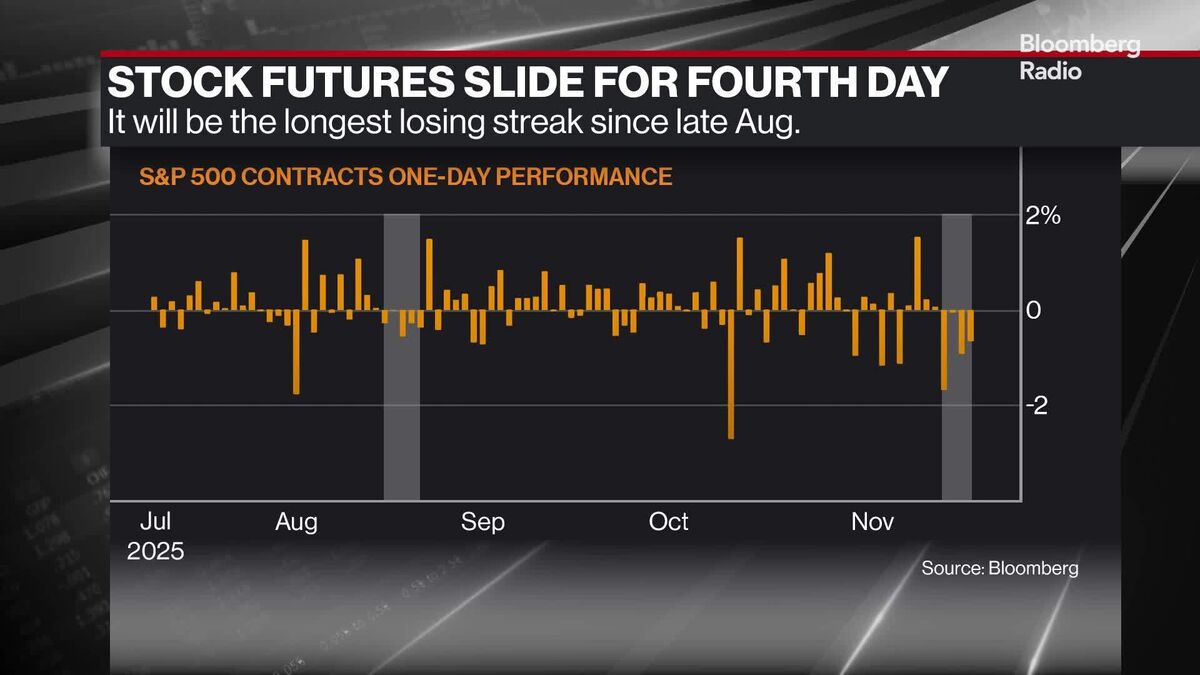

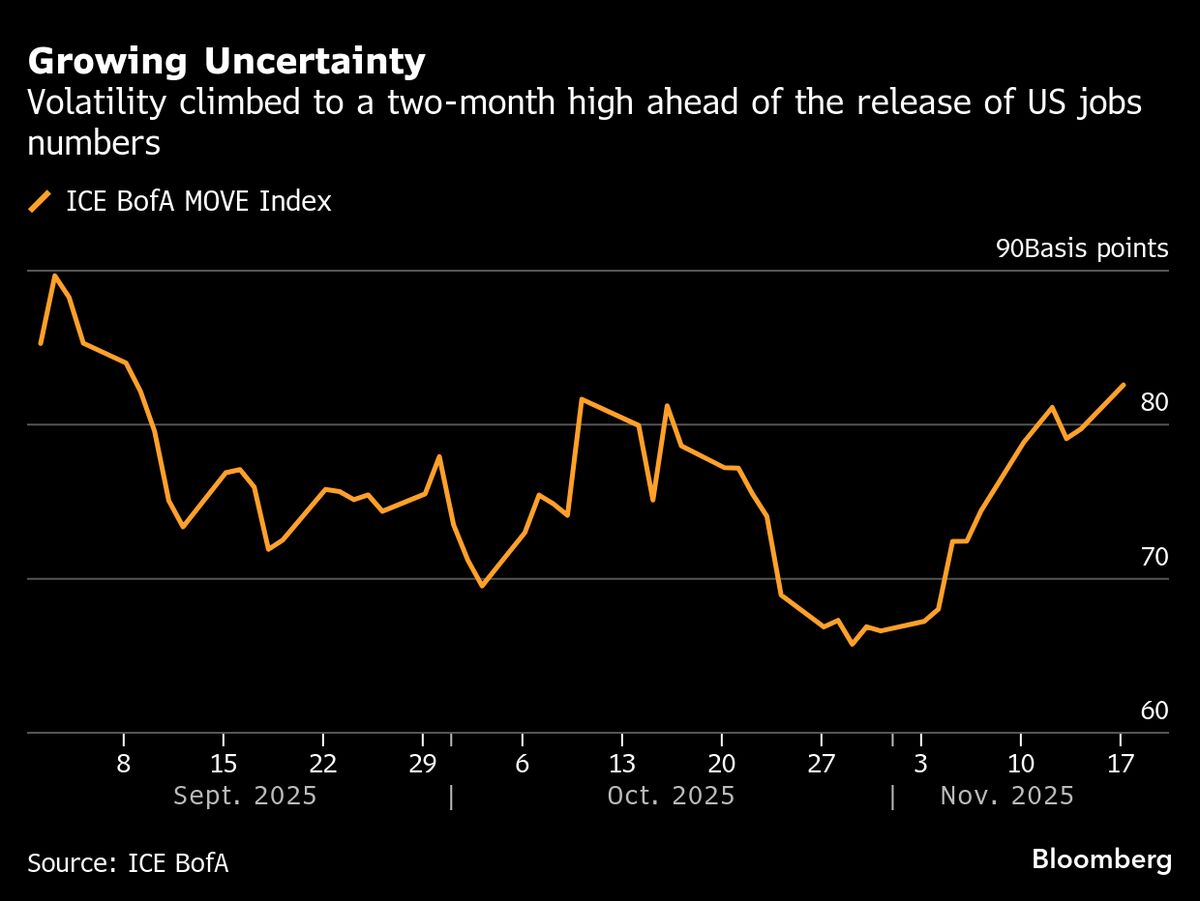

- US stock futures and Bitcoin have managed to reduce their losses, signaling a possible stabilization in global markets after a recent selloff. This shift is accompanied by rising Treasury yields and a steady dollar, indicating a change in investor sentiment.

- The recovery in stock futures and Bitcoin is significant as it may reflect growing confidence among investors, who are closely monitoring economic indicators and market trends. A stable dollar and rising Treasury yields could enhance market stability.

- The broader context reveals ongoing concerns about economic data and trade tensions, which have influenced market dynamics. While some sectors show resilience, the overall market remains sensitive to external factors, including inflation data and geopolitical developments, highlighting the complex interplay of global economic forces.

— via World Pulse Now AI Editorial System