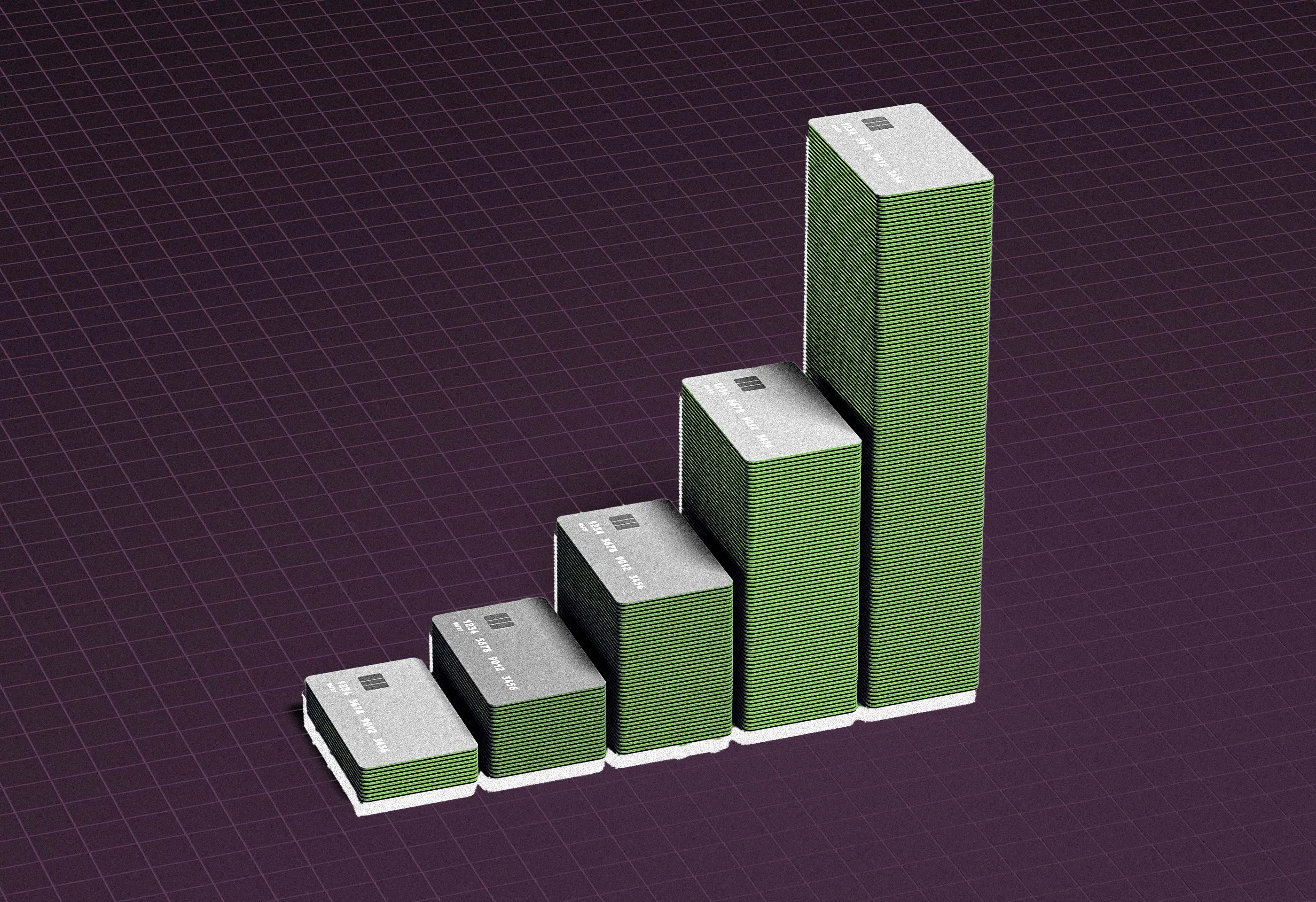

$1,000 Annual Fees on Premium Credit Cards Could Soon Be the New Normal

NeutralFinancial Markets

Premium credit cards may soon come with annual fees of $1,000, a trend driven by card issuers looking to enhance benefits for users. This shift reflects the evolving landscape of credit card offerings, where higher fees could mean better rewards and services. It's important for consumers to weigh the potential advantages against the costs, as this change could redefine how they choose their credit cards.

— Curated by the World Pulse Now AI Editorial System