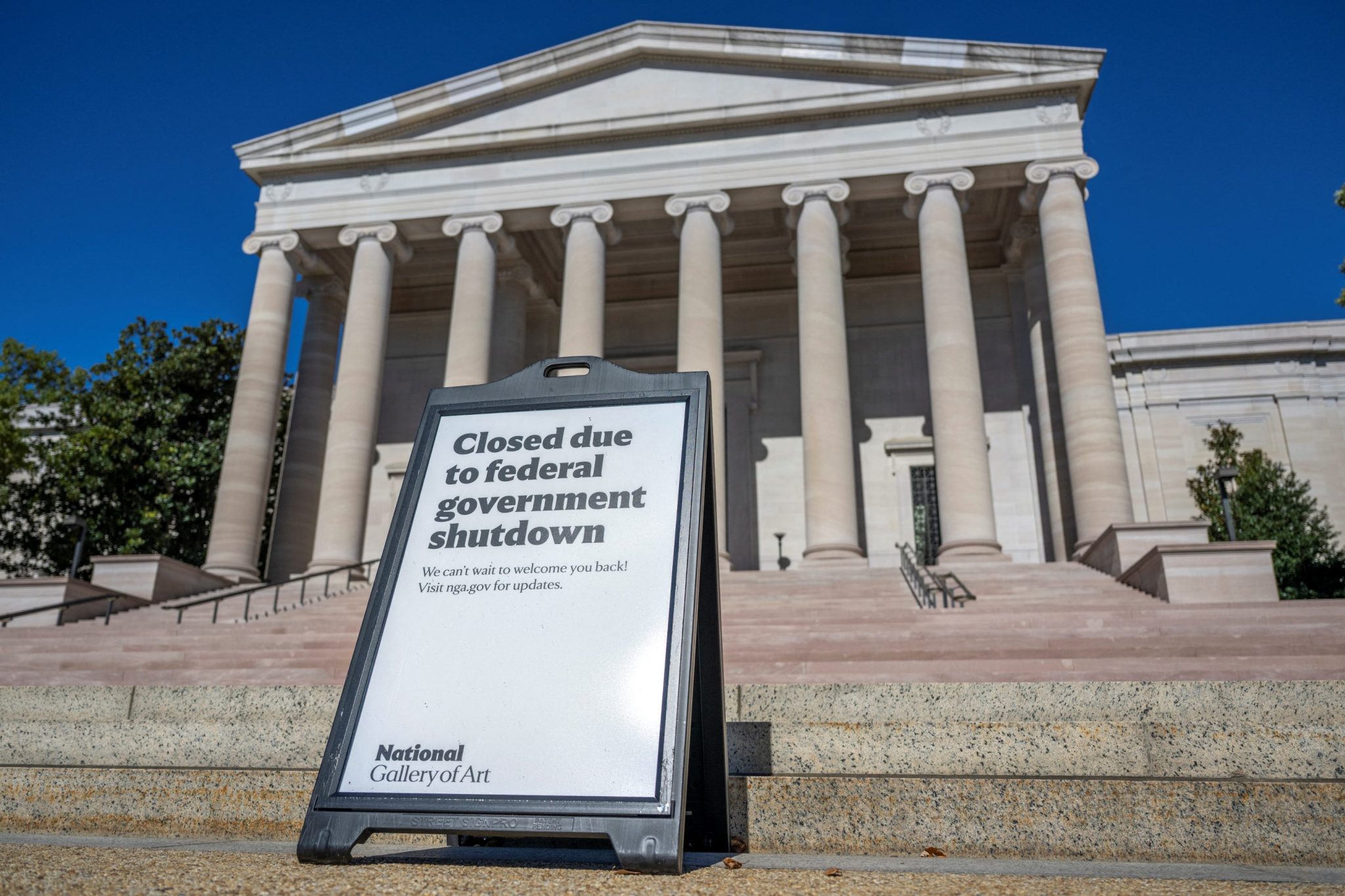

The Big Changes To ACA Premiums At The Heart Of The Government Shutdown

NegativeFinancial Markets

The upcoming changes to ACA premiums are raising concerns as health care coverage through the Marketplaces is set to become more expensive in 2026. With premiums increasing and enhanced premium tax credits scheduled to expire, many individuals and families may face financial strain. This situation is particularly significant as it coincides with the looming threat of a government shutdown, which could further complicate access to affordable health care. Understanding these changes is crucial for those relying on these programs.

— Curated by the World Pulse Now AI Editorial System