Comex Gold Settles 0.44% Higher at $3983.70

PositiveFinancial Markets

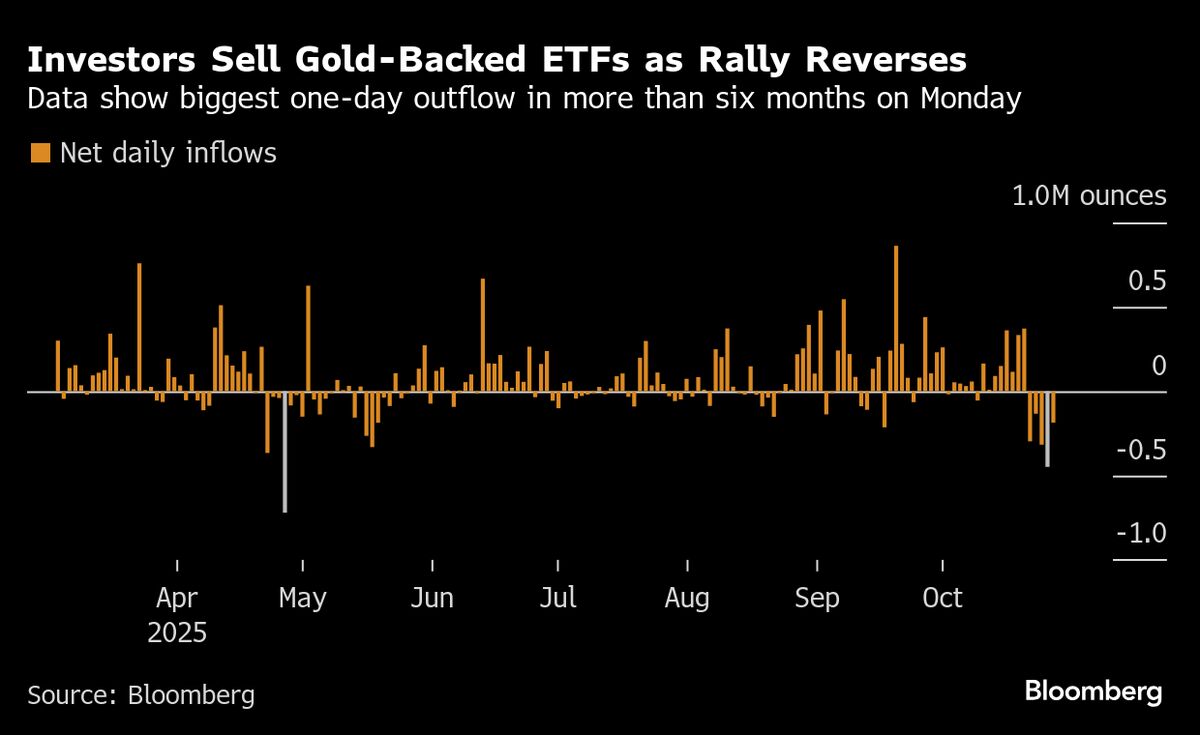

Gold prices have rebounded, settling 0.4% higher at $3983.70, breaking a three-session losing streak. This positive shift is significant as it indicates renewed investor confidence in gold, while silver also saw a rise of 1.3%, marking its second consecutive day of gains. Such trends in precious metals can reflect broader economic sentiments and influence investment strategies.

— Curated by the World Pulse Now AI Editorial System