Hong Kong’s Day Traders Chase Leveraged ETFs After US Tech Boom

PositiveFinancial Markets

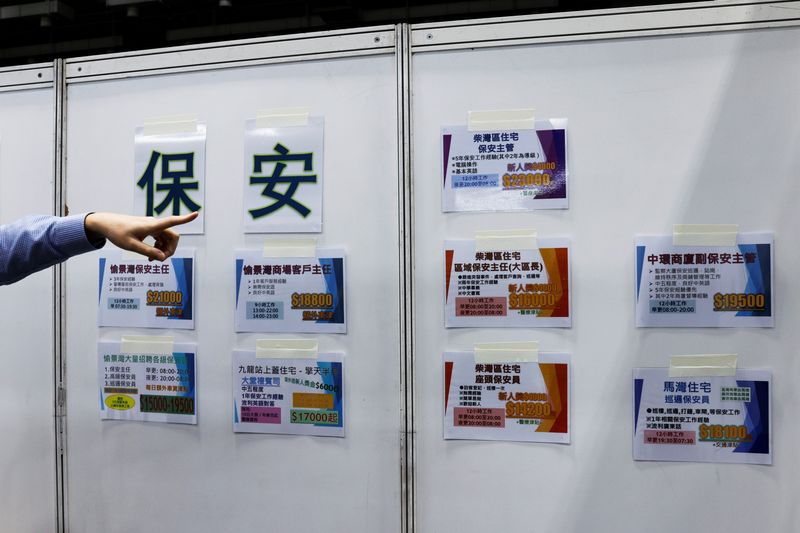

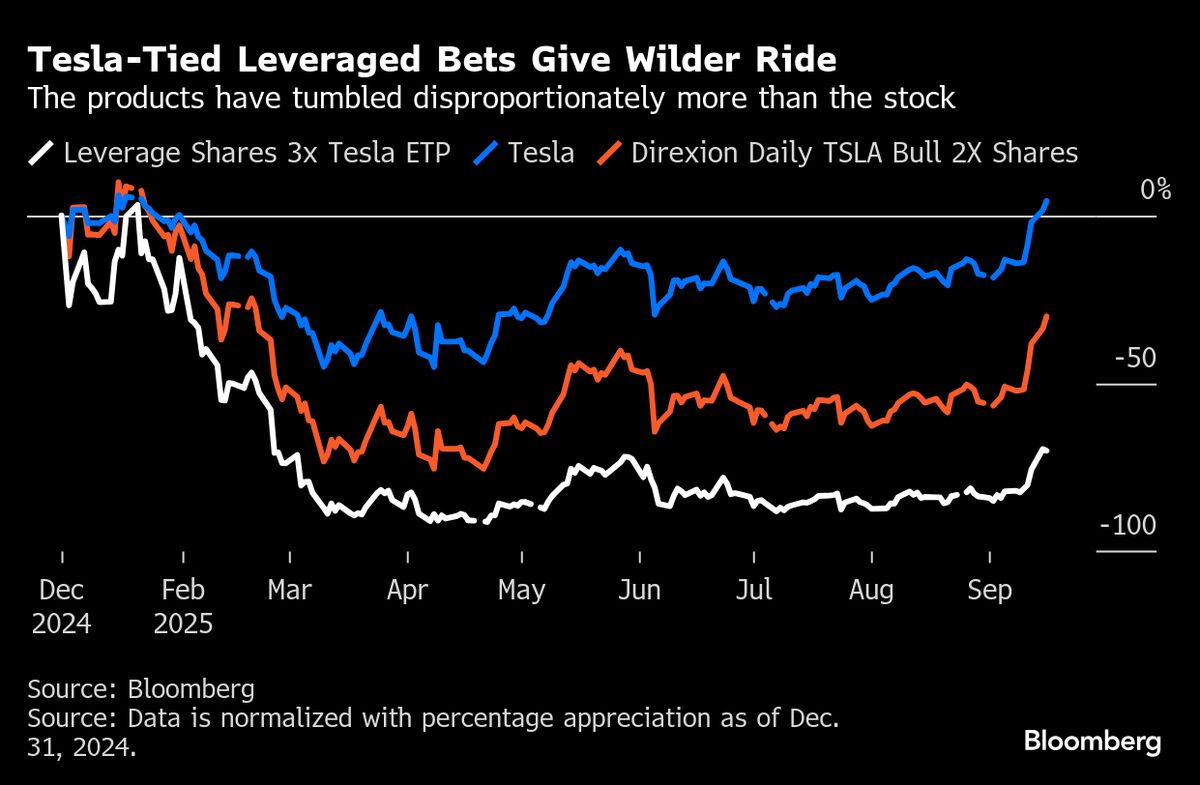

Pat Miao, a 30-year-old from Hong Kong, has left her office job to dive into the exciting world of trading leveraged ETFs, which promise amplified returns on popular US tech stocks like Tesla. This shift highlights a growing trend among day traders in Hong Kong, eager to capitalize on the recent tech boom in the US. As more individuals explore trading opportunities, it reflects a broader interest in financial markets and the potential for significant gains, making it an important development in the investment landscape.

— Curated by the World Pulse Now AI Editorial System