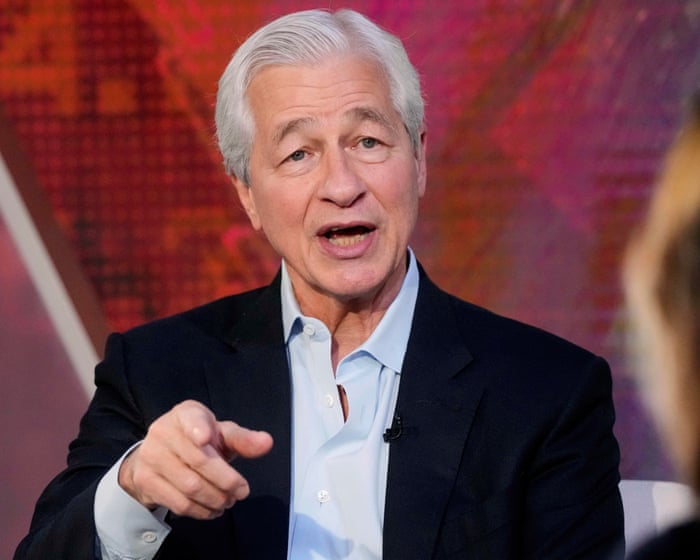

Jamie Dimon issues private credit warning: ‘When you see one cockroach, there are probably more’

NeutralFinancial Markets

Jamie Dimon has raised concerns about the private credit market, suggesting that issues may be more widespread than they appear. While JP Morgan's CFO Jeremy Barnum reassures that many private credit players are highly skilled and maintain good underwriting standards, Dimon's warning serves as a reminder to remain vigilant in the financial landscape. This matters because it highlights the potential risks in private credit, which could impact investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System