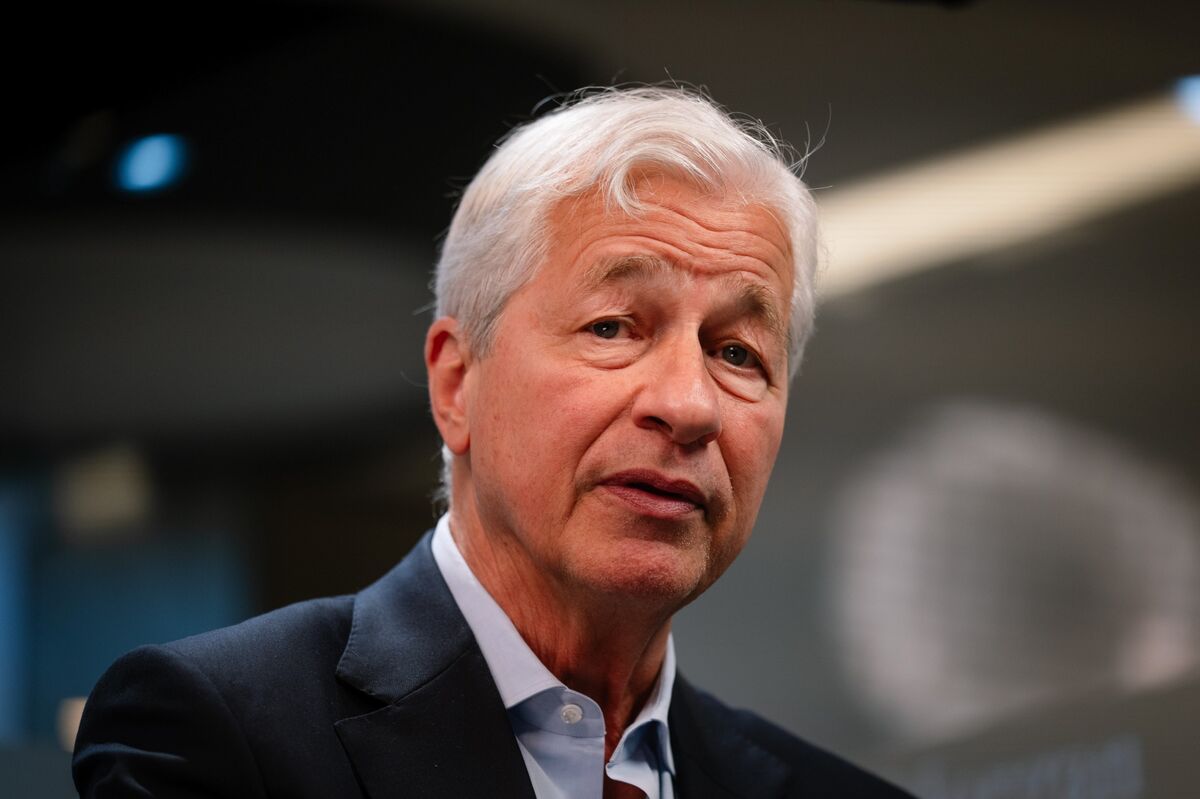

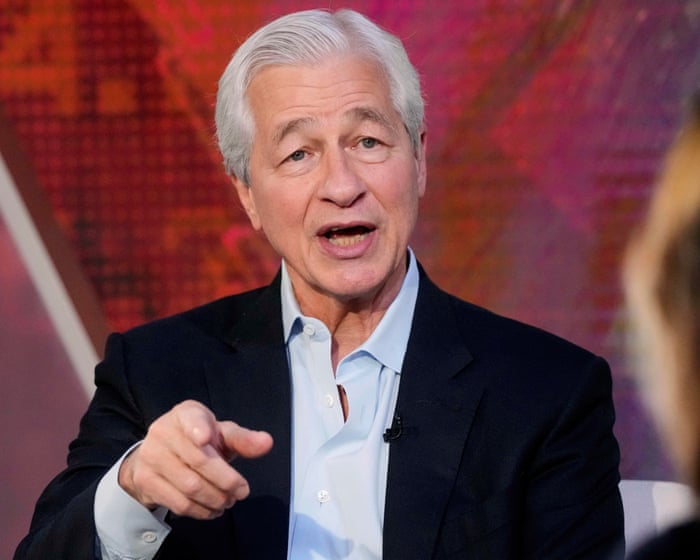

JP Morgan boss says more ‘cockroaches’ will emerge after private credit sector failures

NegativeFinancial Markets

JP Morgan's CEO Jamie Dimon has raised concerns about the private credit sector, predicting that more failures, or 'cockroaches', will surface following the recent collapses of Tricolor and First Brands. This situation is significant as it highlights vulnerabilities in the shadow banking system, which could lead to broader financial instability and impact investors and consumers alike.

— Curated by the World Pulse Now AI Editorial System