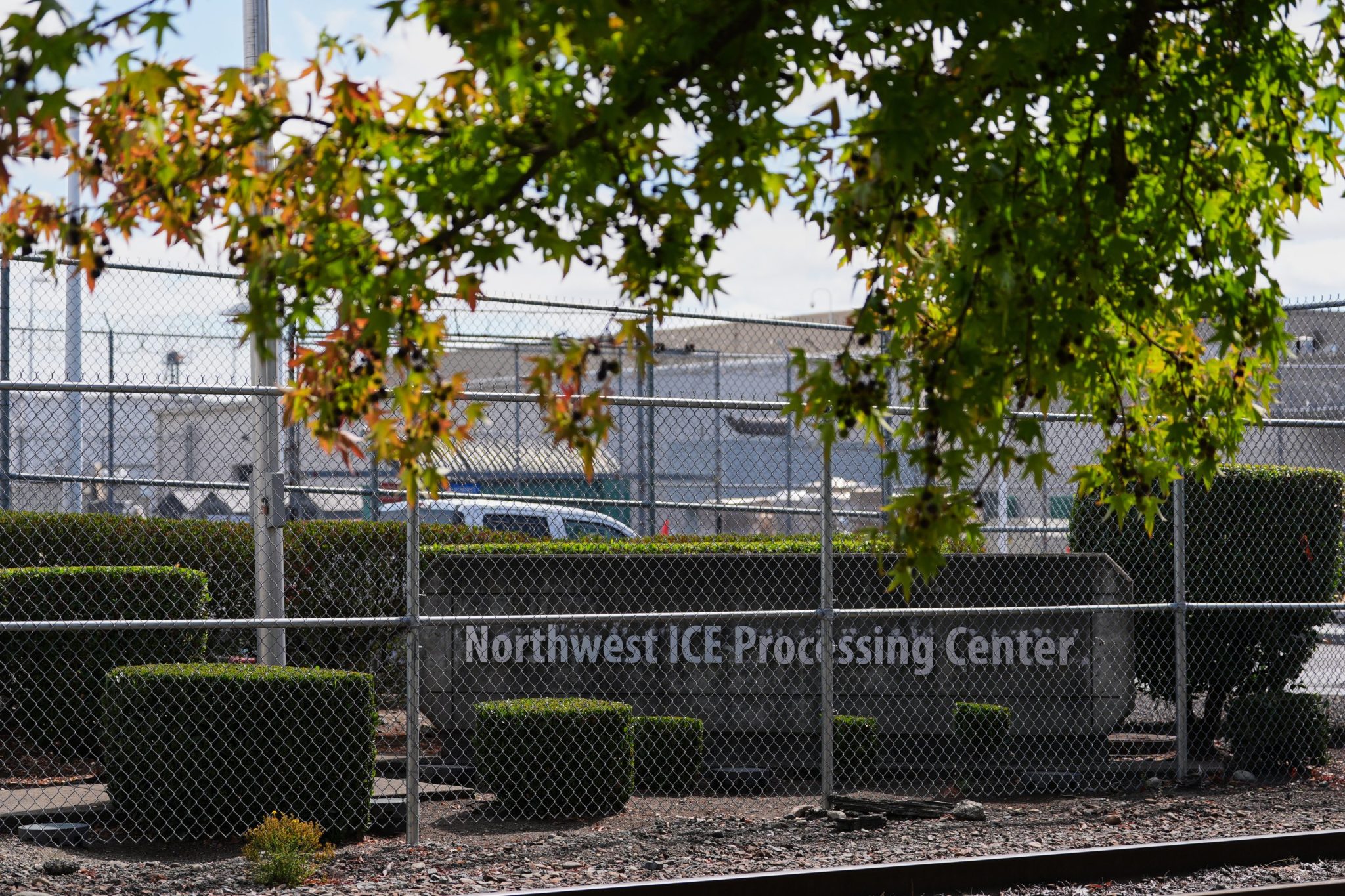

Meet a 62-year-old Washington state farmworker who chose self-deportation to Mexico after raising 4 children and 10 grandchildren in the U.S.

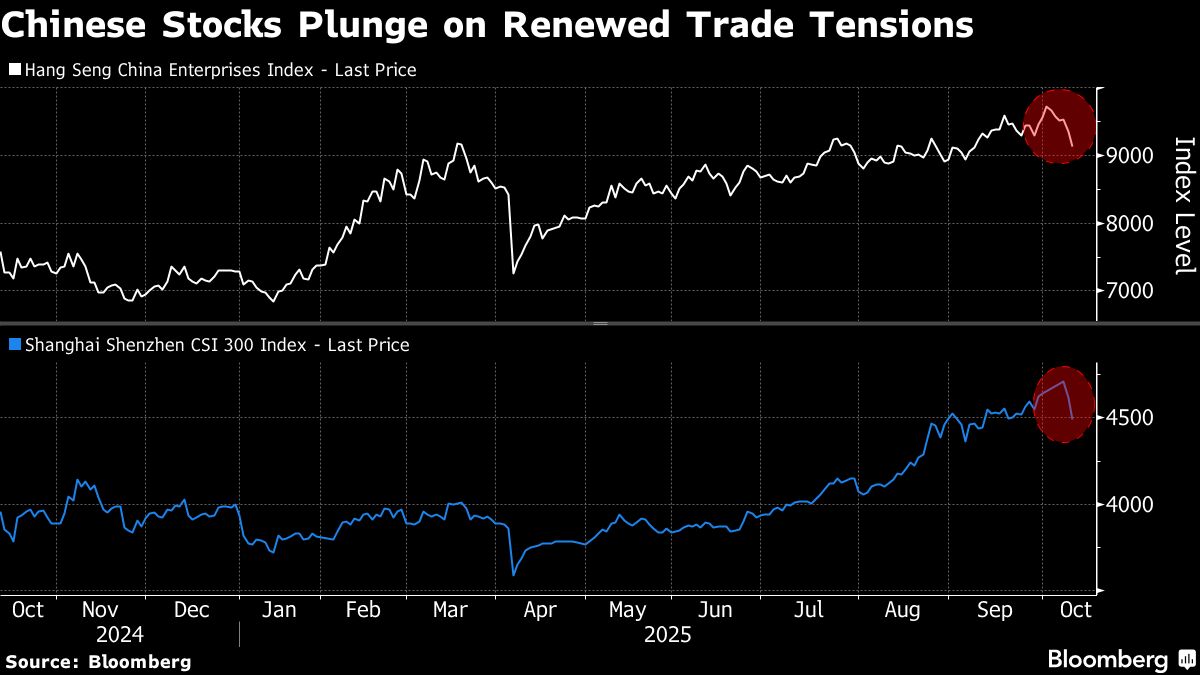

NegativeFinancial Markets

Ramón Rodriguez Vazquez, a 62-year-old farmworker from Washington state, made the difficult decision to self-deport to Mexico after years of contributing to his community and raising a family in the U.S. His health deteriorated significantly during his time in ICE custody, highlighting the harsh realities faced by many immigrants. This story matters because it sheds light on the personal struggles and sacrifices of individuals caught in the immigration system, emphasizing the need for reform and compassion.

— Curated by the World Pulse Now AI Editorial System