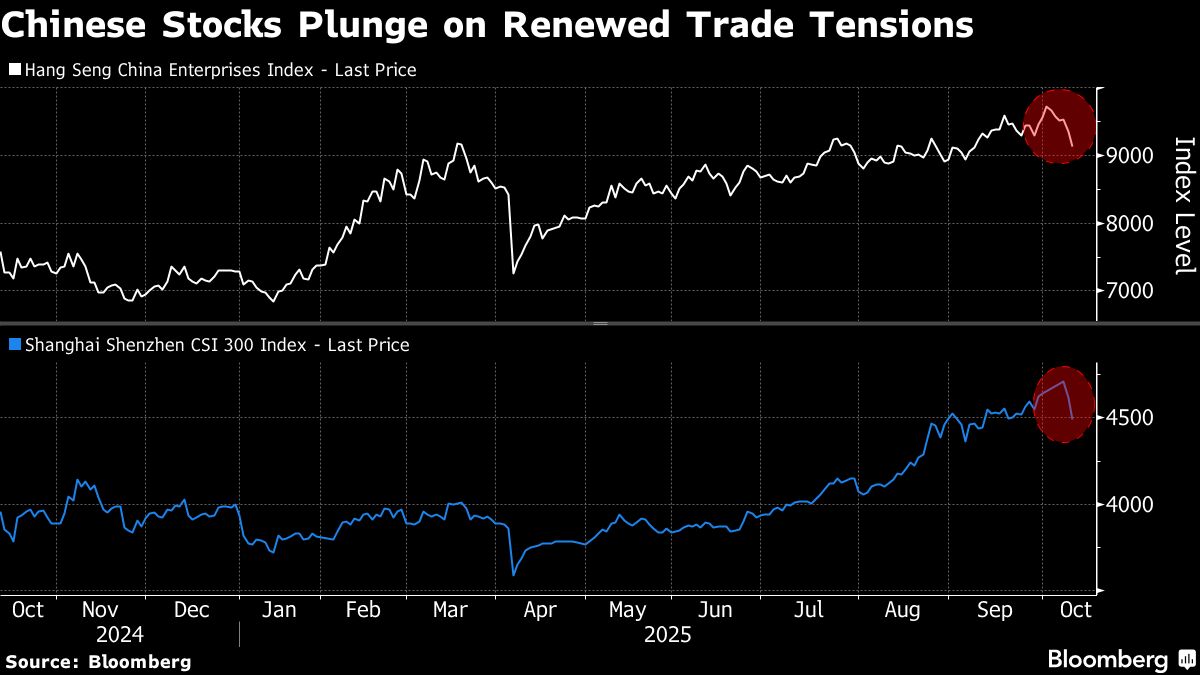

Chinese Stocks Slide as Renewed Trade Tensions Threaten Bull Run

NegativeFinancial Markets

Chinese stocks have taken a hit as fears of renewed trade tensions between Beijing and Washington loom large. This decline has made investors uneasy, leading to a rise in bond futures. Interestingly, the offshore yuan saw a rebound thanks to the central bank's strong fixing. This situation is significant as it highlights the fragile state of international trade relations and its direct impact on market stability.

— Curated by the World Pulse Now AI Editorial System