WeRide CEO Tony Han on Hong Kong Listing

PositiveFinancial Markets

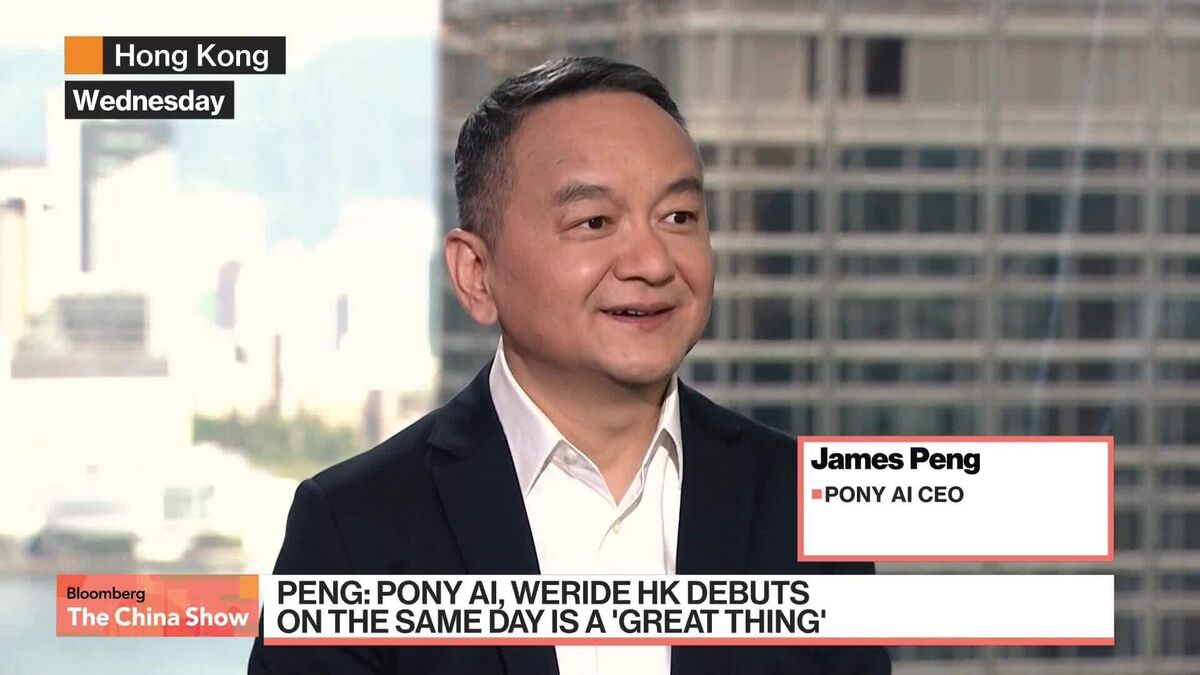

WeRide CEO Tony Han on Hong Kong Listing

WeRide, a leading autonomous driving company from China, has successfully debuted on the Hong Kong stock exchange. CEO Tony Han views this listing as a significant milestone for the company, which plans to utilize the funds raised for expanding its recruitment efforts, enhancing its data center, and building a global taxi fleet. This move not only highlights WeRide's growth ambitions but also reflects the increasing interest in autonomous technology in the global market.

— via World Pulse Now AI Editorial System