Oil edges lower amid worries over US economy, market oversupply

NegativeFinancial Markets

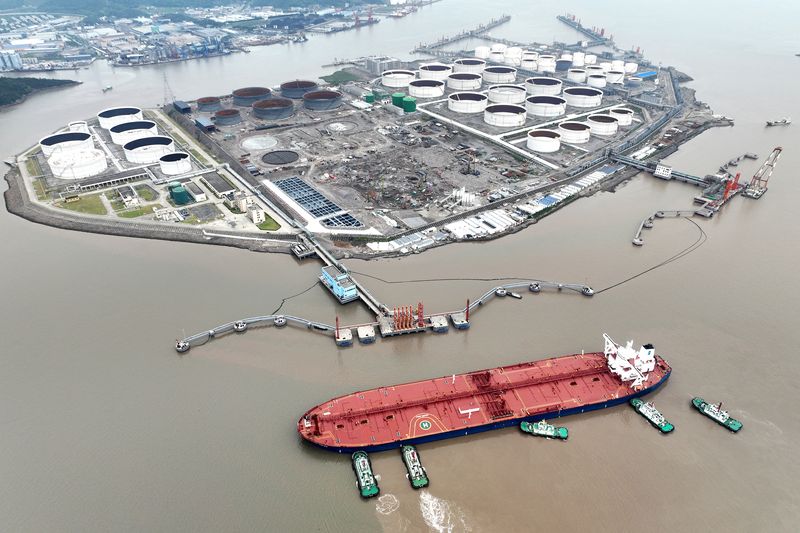

Oil prices have dipped as concerns grow over the US economy and potential market oversupply. This decline is significant as it reflects investor anxiety about economic stability and its impact on energy demand. With the market facing these challenges, stakeholders are closely monitoring developments that could influence future pricing and supply dynamics.

— Curated by the World Pulse Now AI Editorial System