Asian Stocks Poised to Gain on Fed Rate-Cut Bets: Markets Wrap

PositiveFinancial Markets

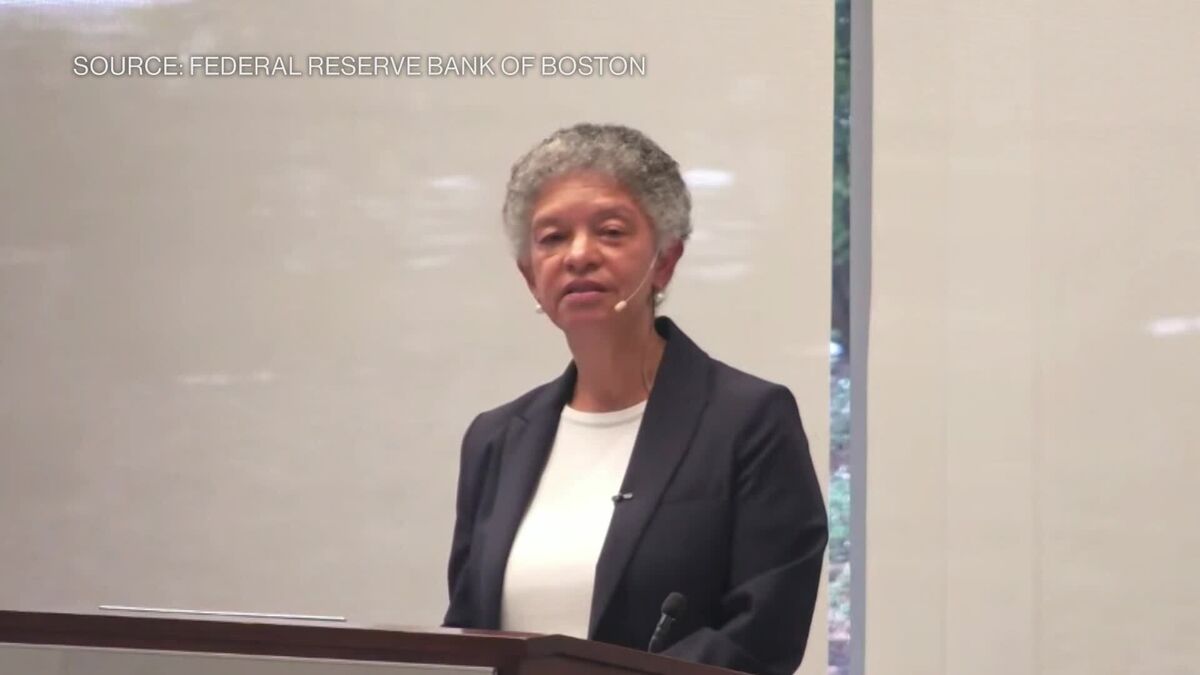

Asian stocks are set to open stronger as investors are optimistic about a potential interest-rate cut by the Federal Reserve, which seems to outweigh concerns over renewed trade tensions between the US and China. This is significant because a rate cut could stimulate economic growth and boost market confidence, making it a crucial moment for investors.

— Curated by the World Pulse Now AI Editorial System