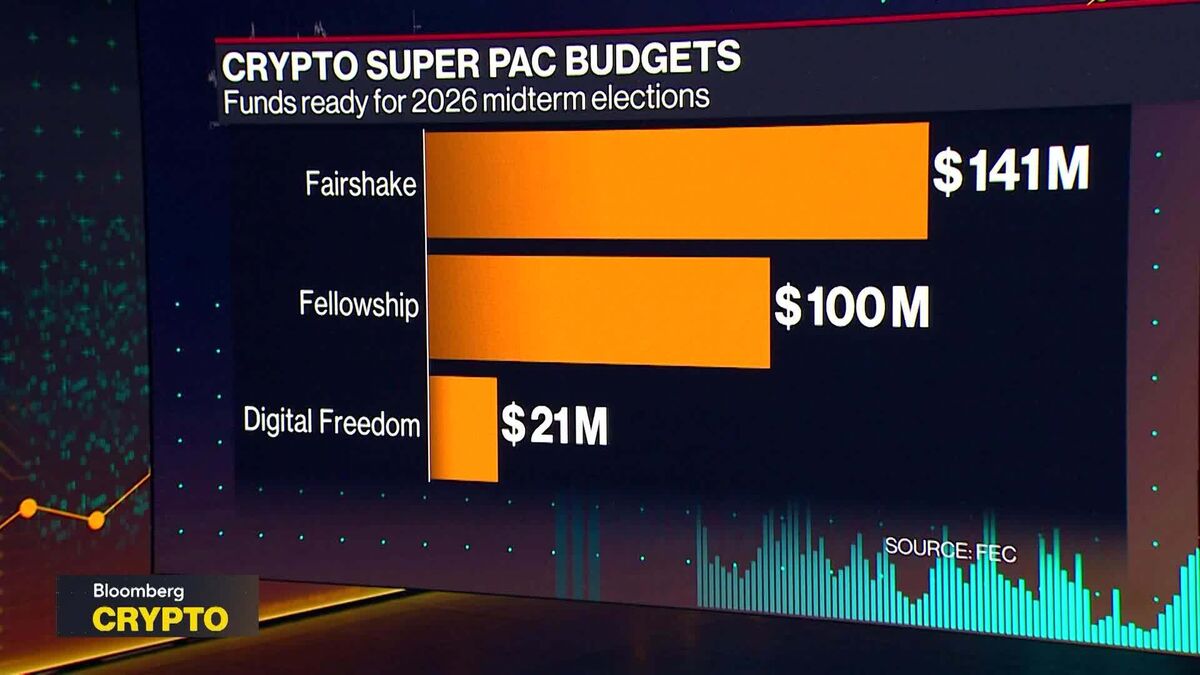

Crypto’s Political Machine $263 Million to Rival Big Oil

PositiveFinancial Markets

The crypto industry is gearing up for the 2026 midterms with a significant financial boost, amassing around $263 million through super political action committees. This amount nearly doubles the spending of the largest committee in the 2024 elections, showcasing the growing influence of crypto in politics.

— Curated by the World Pulse Now AI Editorial System