BCA sees room for a bigger U.S. dollar rebound

PositiveFinancial Markets

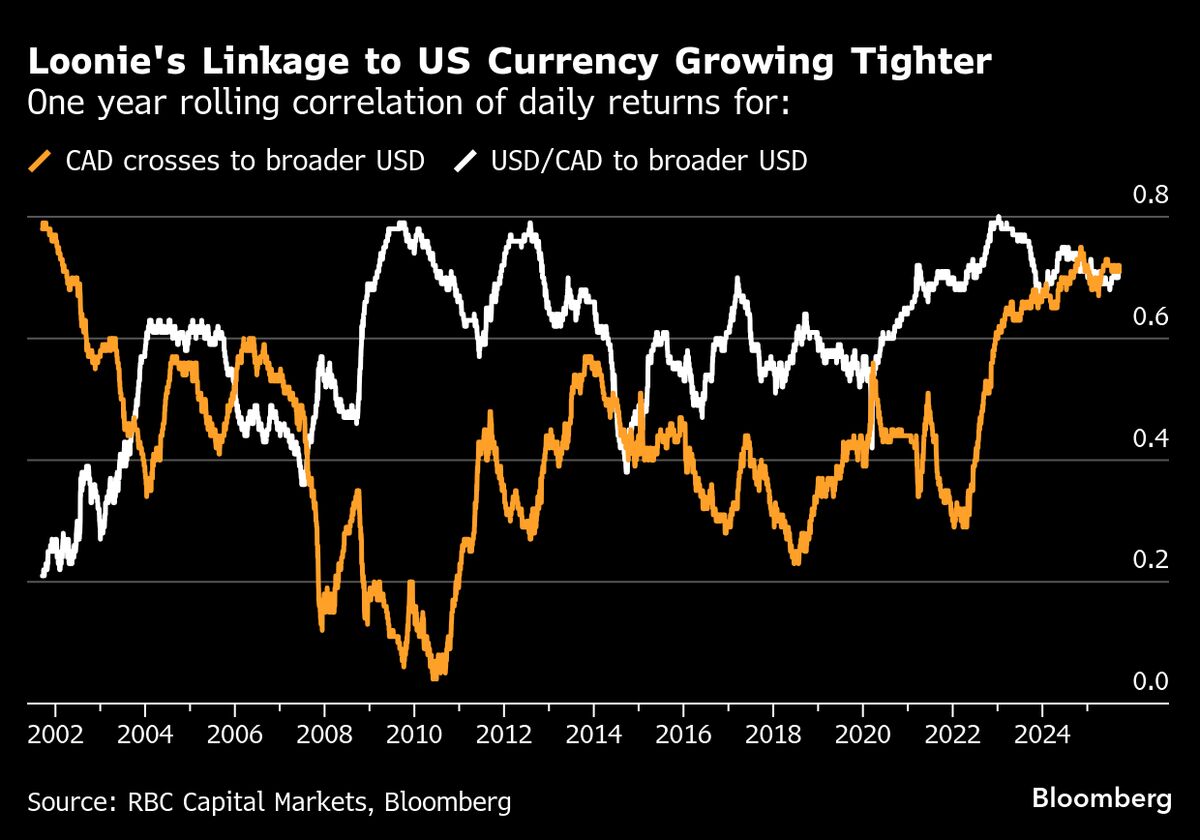

BCA has identified potential for a significant rebound in the U.S. dollar, suggesting that investors should consider this trend in their financial strategies. This insight is crucial as it could influence global markets and investment decisions, highlighting the importance of staying informed about currency fluctuations.

— Curated by the World Pulse Now AI Editorial System