US Treasuries Rally After Fed Delivers Quarter-Point Rate Cut

PositiveFinancial Markets

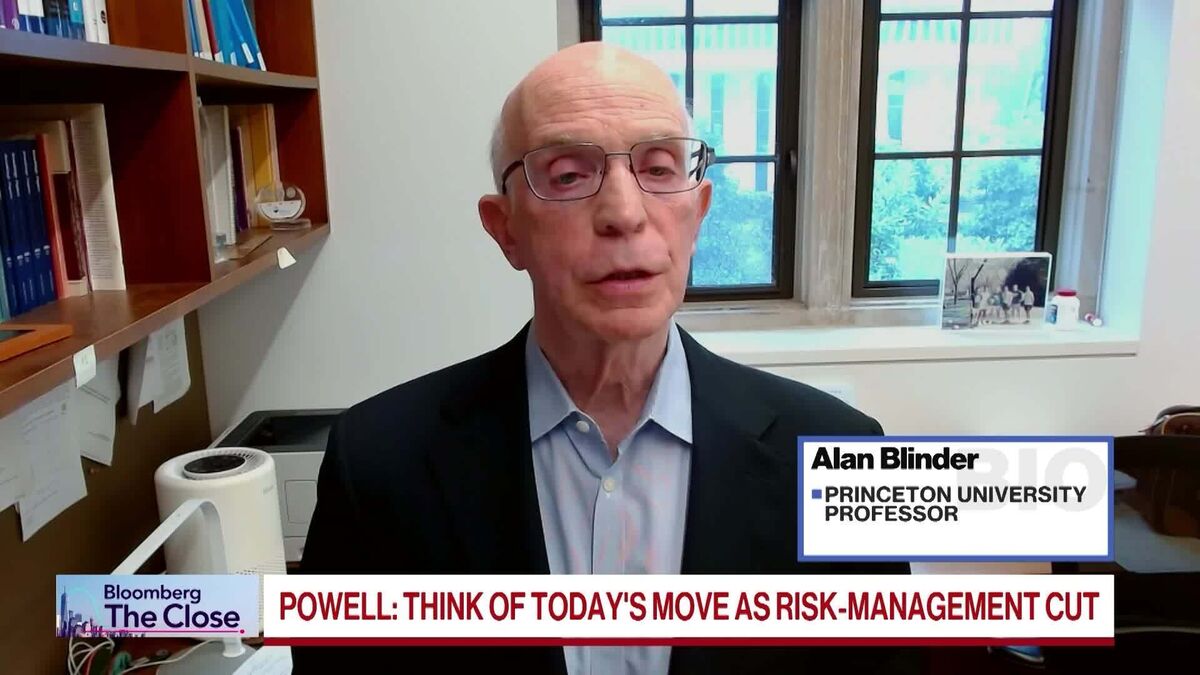

US Treasuries saw a rally following the Federal Reserve's decision to implement a quarter-point rate cut, a move aimed at bolstering the struggling labor market. This development is significant as it reflects the Fed's proactive approach to stimulate economic growth and support employment, which can have positive ripple effects across various sectors.

— Curated by the World Pulse Now AI Editorial System