S&P 500 Rises Before Fed, Nvidia Hits Historic $5 Trillion Mark

PositiveFinancial Markets

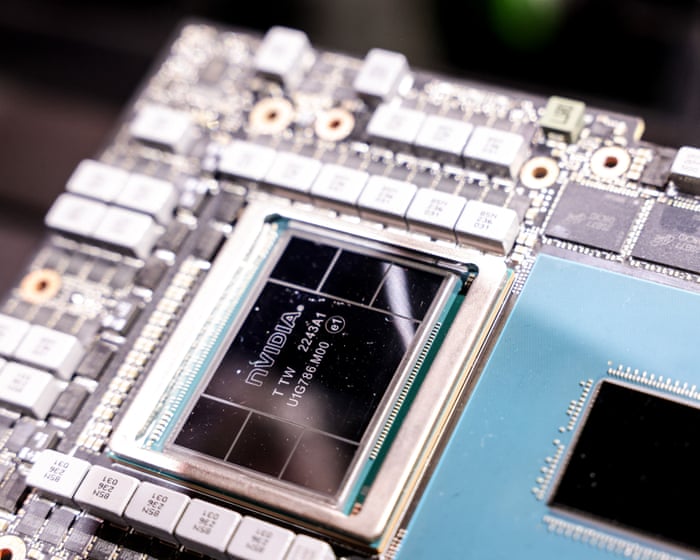

The S&P 500 is experiencing a notable rise as investors anticipate a significant Federal Reserve interest-rate decision and earnings reports from major tech companies. This rally, driven by technology stocks, highlights the market's optimism and the pivotal role of tech giants like Nvidia, which recently reached a historic $5 trillion valuation. Such developments are crucial as they reflect investor confidence and could influence economic trends.

— Curated by the World Pulse Now AI Editorial System