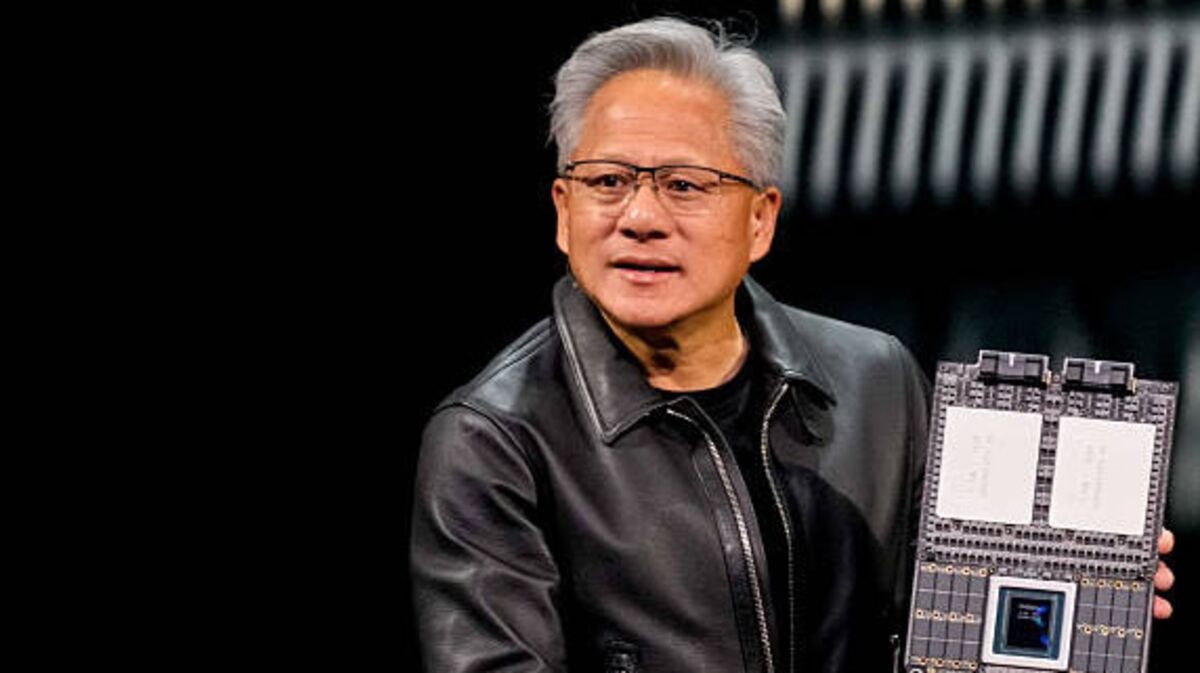

Nvidia becomes world’s first $5tn company

PositiveFinancial Markets

Nvidia has made history by becoming the world's first company to reach a market valuation of $5 trillion, driven by robust sales of its AI systems and the potential for increased access to the Chinese market. This milestone not only highlights Nvidia's dominance in the tech industry but also underscores the growing importance of AI in global markets. Investors are optimistic about the company's future, making it a significant player in the ongoing tech revolution.

— Curated by the World Pulse Now AI Editorial System