Stock Market Today: Nike, Eli Lily surge; Robinhood slips

NeutralFinancial Markets

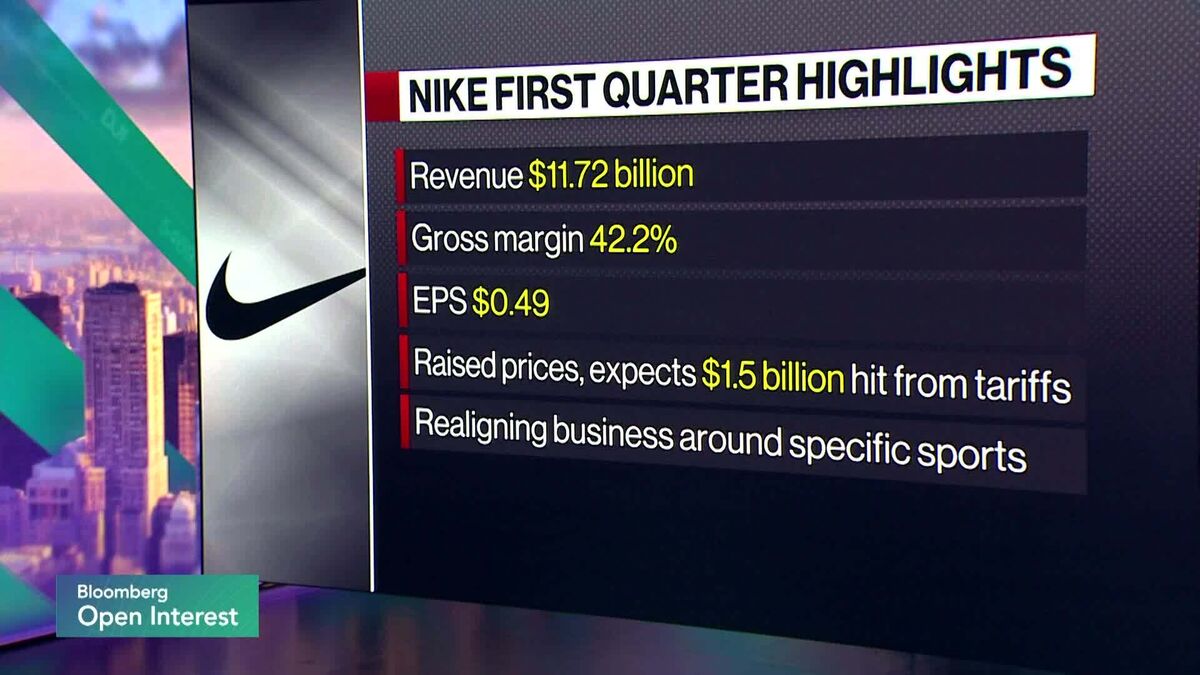

Today's stock market saw significant movements, with Nike and Eli Lilly experiencing notable surges, indicating positive investor sentiment towards these companies. Meanwhile, Robinhood faced a decline, which could reflect broader market trends or specific challenges the platform is facing. Understanding these shifts is crucial for investors looking to navigate the current financial landscape.

— Curated by the World Pulse Now AI Editorial System