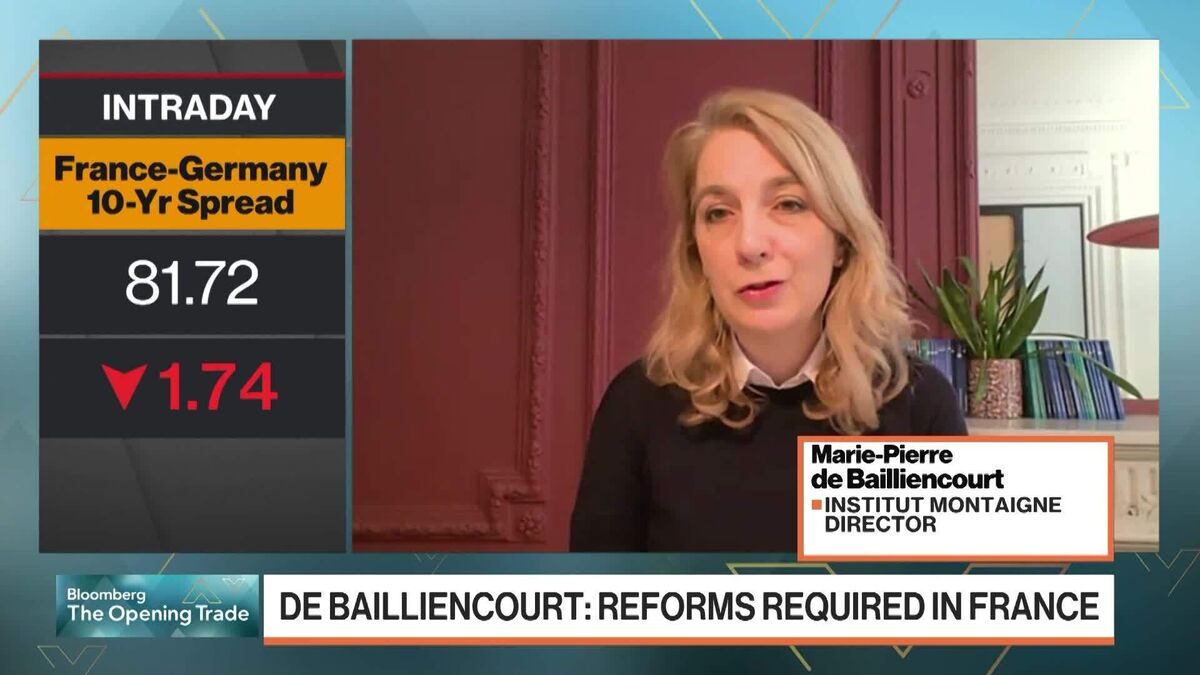

French Think-Tank 'Institut Montaigne' Director: End of an Era in France

PositiveFinancial Markets

Marie-Pierre de Bailliencourt, director of the Institut Montaigne, has declared that the French government has failed its voters, marking what she calls an 'end of an era' for the old political class. She emphasizes the need for change and reform in response to new geopolitical challenges, suggesting that the current political landscape is ripe for transformation. This perspective is significant as it highlights the potential for much-needed reforms that could benefit the French populace, indicating a shift towards a more responsive and modern governance.

— Curated by the World Pulse Now AI Editorial System