AI Is Powerful for Growing GDP: I/O Fund’s Kindig

PositiveFinancial Markets

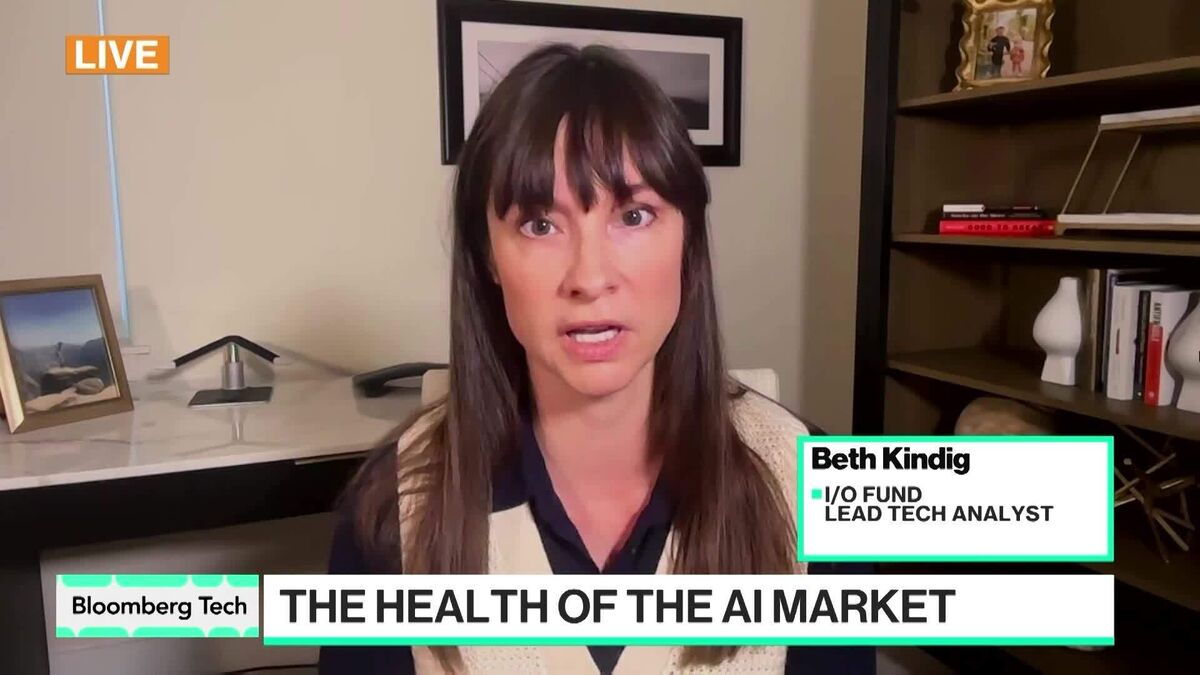

Beth Kindig, the lead tech analyst at I/O Fund, highlights the significant role of AI in boosting GDP, emphasizing the global race to enhance chip manufacturing due to soaring demand. Her insights on Bloomberg Tech underline the urgency for nations to innovate and invest in technology to stay competitive, making this a crucial topic for economic growth.

— Curated by the World Pulse Now AI Editorial System