Volkswagen says it can make new cars entirely in China

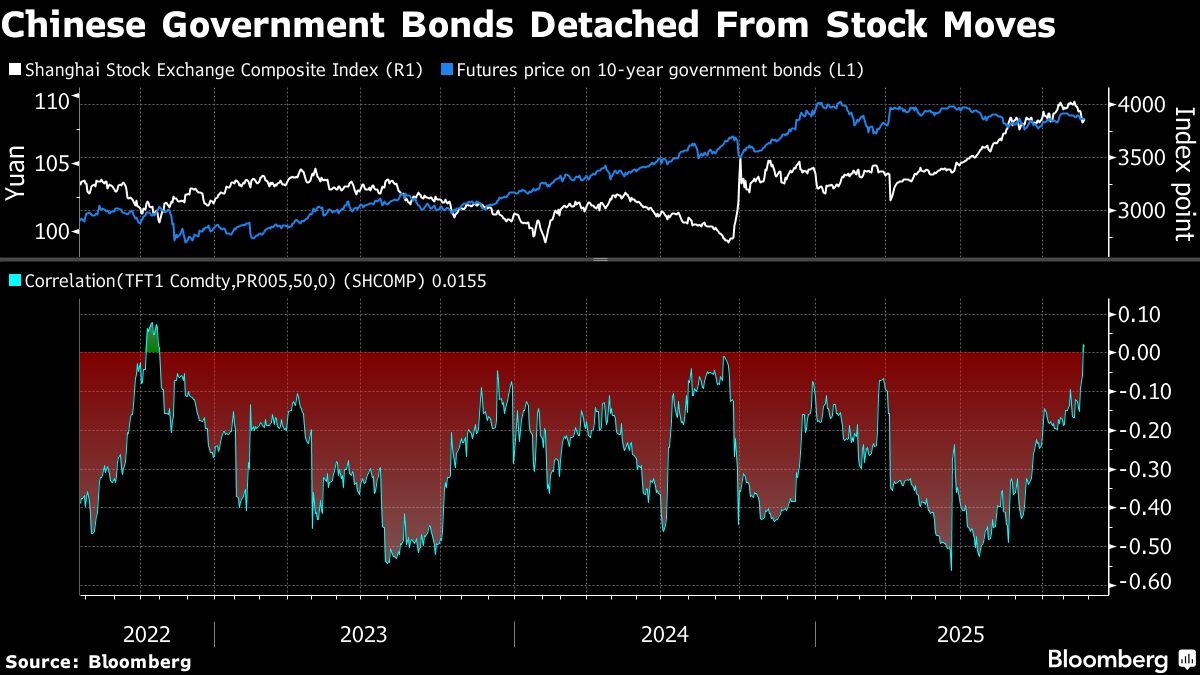

PositiveFinancial Markets

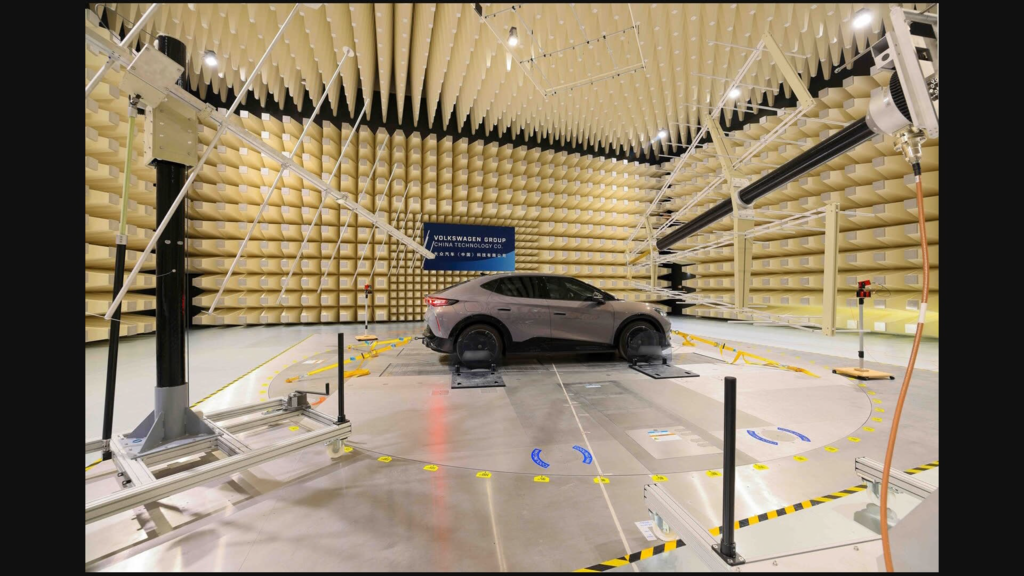

- Volkswagen has announced the completion of a new R&D centre in Hebei, eastern China, enabling the company to develop new cars entirely outside Germany for the first time in its history. This move aims to strengthen its position in the world's largest auto market.

- This development is significant as it reflects Volkswagen's strategy to regain market share in China, a critical region for automotive sales, and highlights the growing importance of local innovation in the global automotive industry.

— via World Pulse Now AI Editorial System