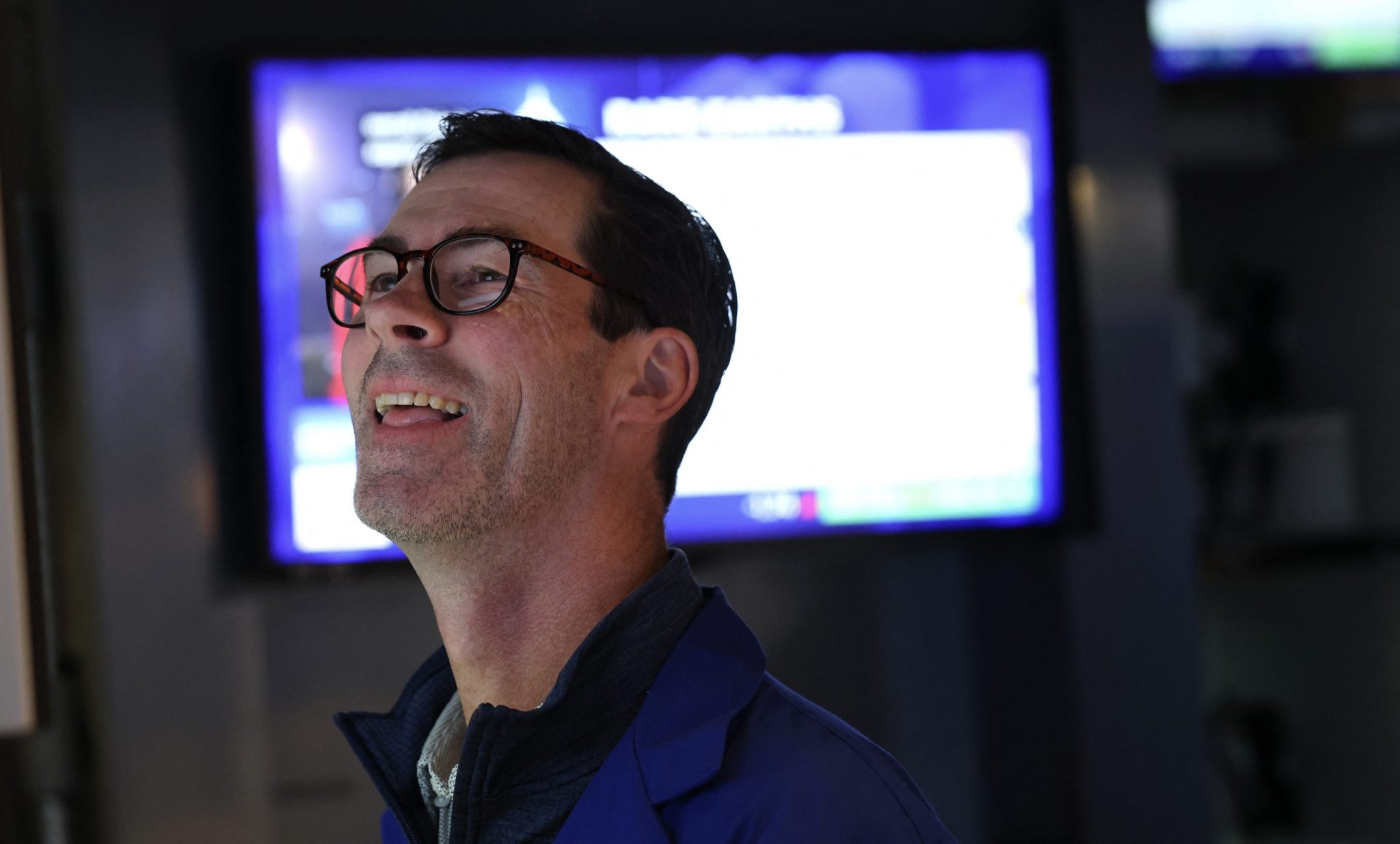

Wall Street Bonuses Expected to Surge Again

PositiveFinancial Markets

Wall Street Bonuses Expected to Surge Again

Wall Street bonuses are on the rise again, with a report from Johnson Associates indicating that equity traders could see increases of up to 25%. This surge is attributed to market volatility and a resurgence in dealmaking, which is boosting profits across the board. Investment bankers and asset managers are also expected to enjoy significant payouts, while wealth managers may see double-digit increases. This trend is important as it reflects the overall health of the financial sector and can influence economic activity.

— via World Pulse Now AI Editorial System