South Africa Mulls New Eurobonds After $2 Billion Redemption

NeutralFinancial Markets

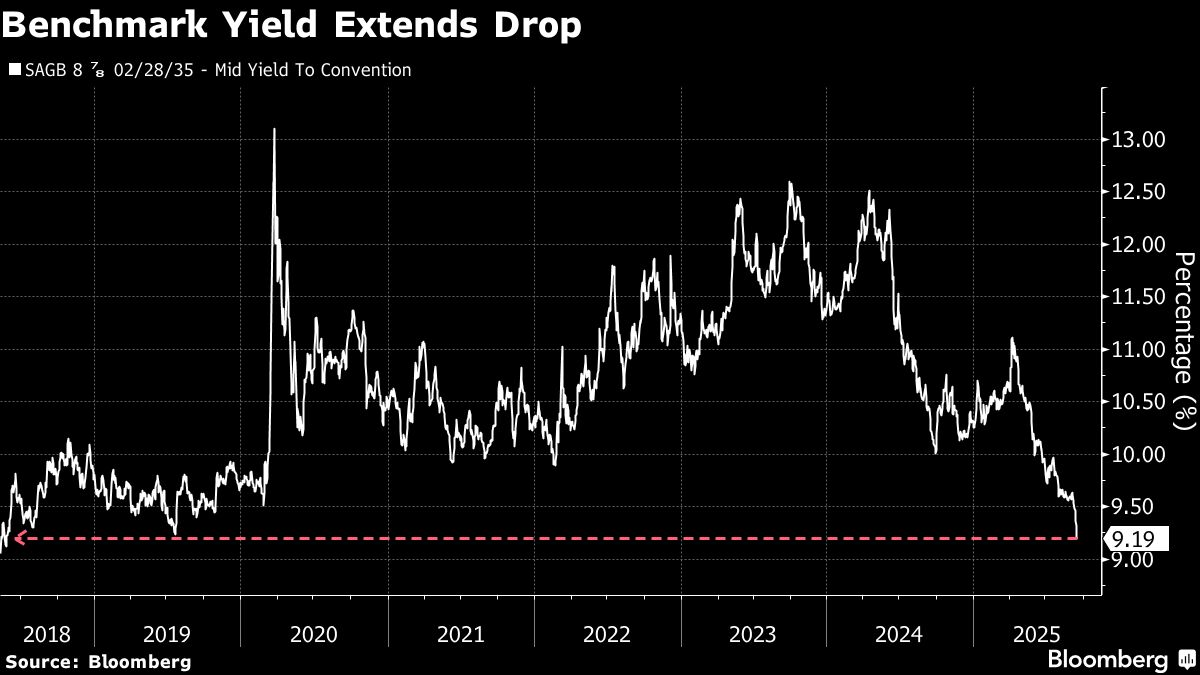

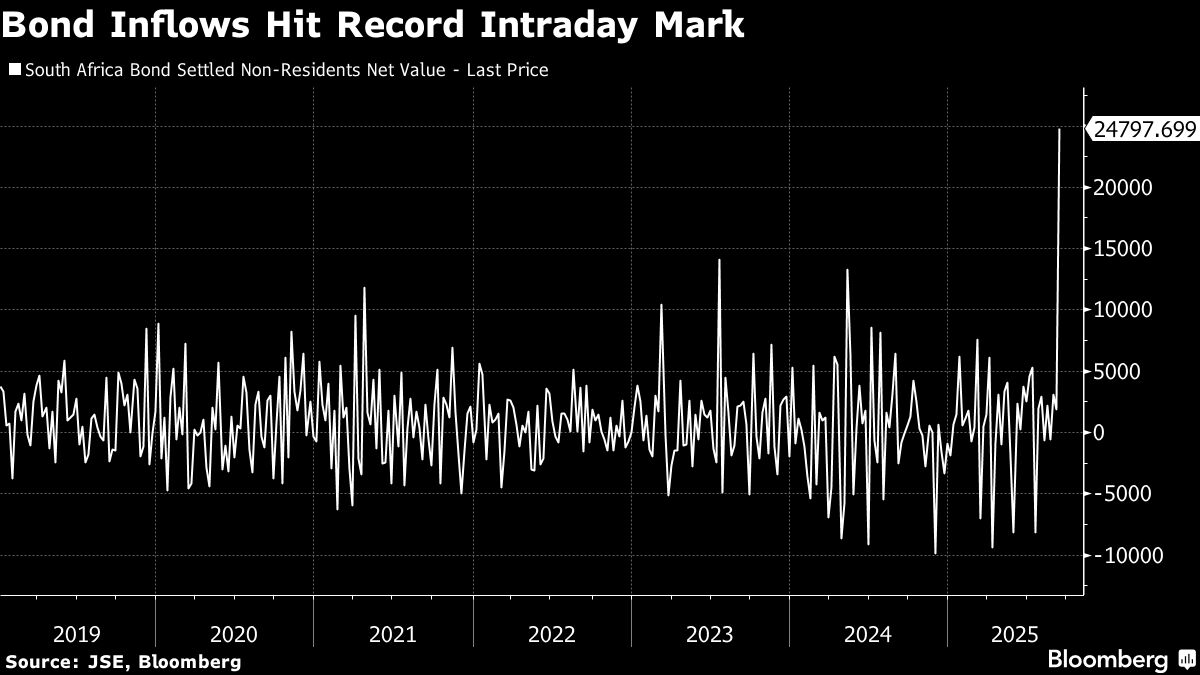

South Africa's National Treasury is exploring the possibility of issuing new Eurobonds following the recent repayment of a $2 billion bond. This move is aimed at replenishing cash reserves, which is crucial for maintaining financial stability. The decision to tap into the Eurobond market reflects the government's proactive approach to managing its debt and ensuring liquidity in the economy.

— Curated by the World Pulse Now AI Editorial System