US Initial Jobless Claims Hit Three-Year Low

PositiveFinancial Markets

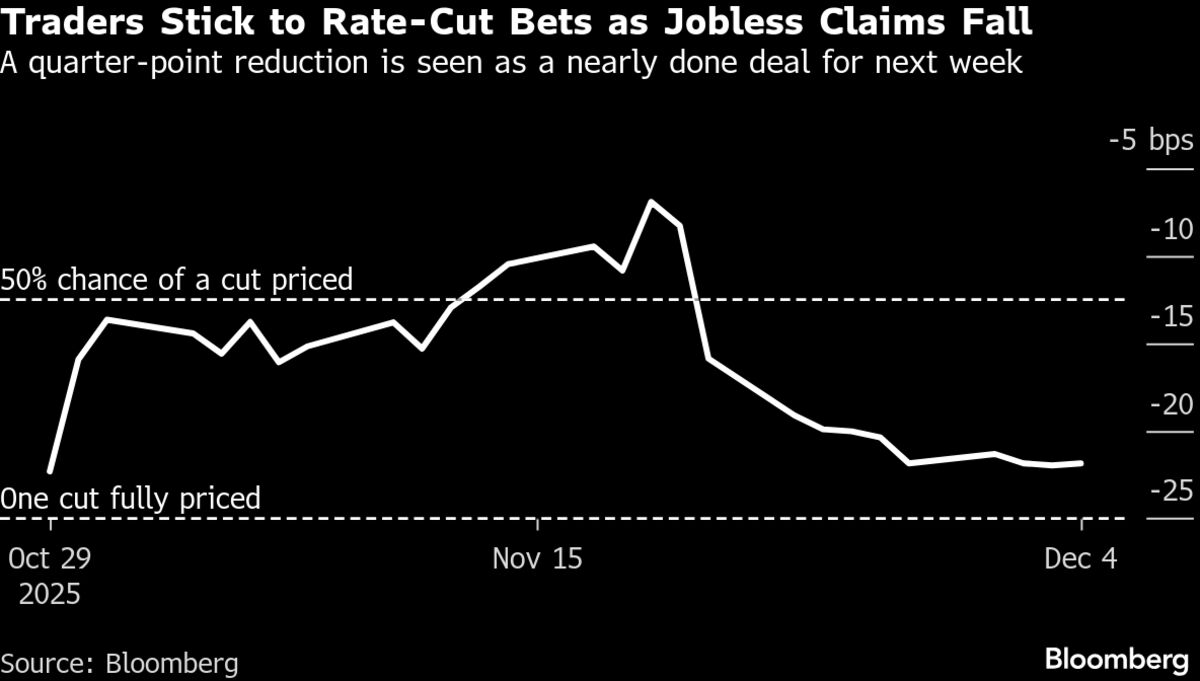

- US initial jobless claims fell by 27,000 to 191,000 for the week ending November 29, marking the lowest level in over three years. This decline reflects a significant improvement in the labor market, as reported by Bloomberg's Enda Curran.

- The drop in jobless claims indicates that employers are retaining workers despite recent layoffs, suggesting a more stable employment environment. This trend is crucial for economic recovery and consumer confidence as it signals resilience in the job market.

- While jobless claims have decreased, recent data indicates a concerning trend in private payrolls, which saw a notable decline of 32,000 jobs in November. This juxtaposition highlights the complexities of the labor market, where initial claims are falling, yet layoffs are impacting overall employment figures, suggesting a mixed economic outlook.

— via World Pulse Now AI Editorial System