Treasuries Slide as New Jobless Claims Unexpectedly Slump

NegativeFinancial Markets

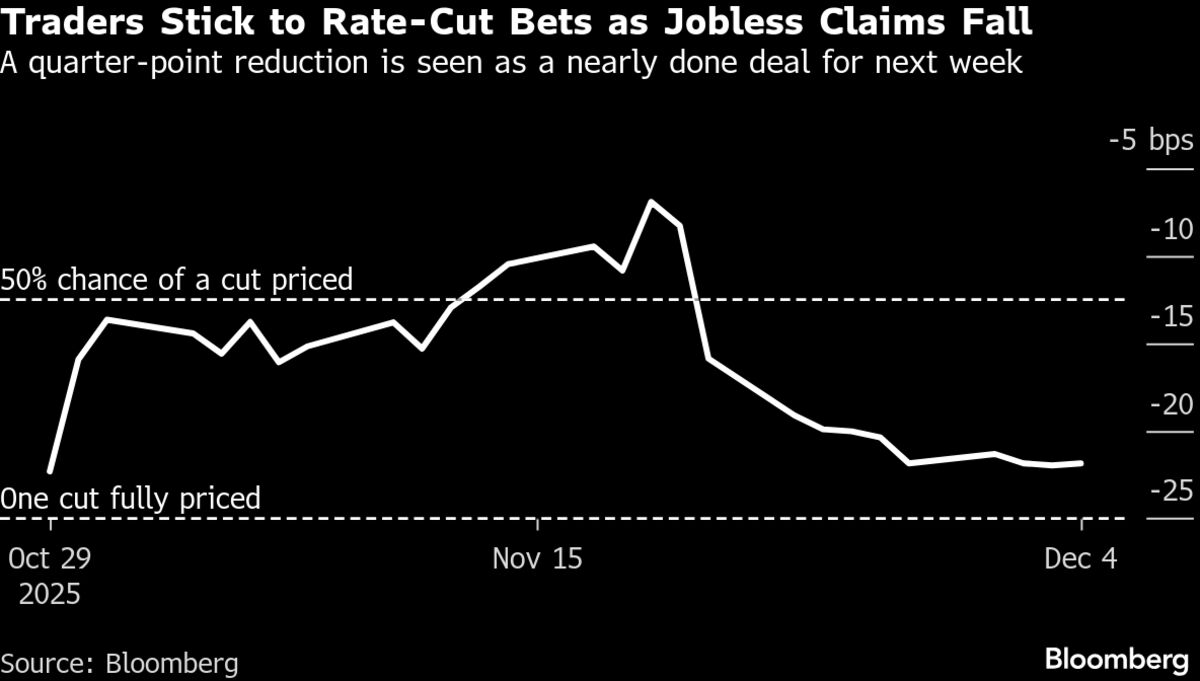

- Treasuries experienced a decline as new jobless claims in the US unexpectedly fell to their lowest level since 2022, indicating a tightening labor market ahead of the Federal Reserve's upcoming rate decision. This drop in claims suggests that employers are retaining workers despite economic uncertainties.

- The decrease in jobless claims is significant as it reflects the resilience of the labor market, which may influence the Federal Reserve's monetary policy. A stable job market could lead to a reassessment of interest rate strategies, particularly in light of recent economic data.

- This development highlights ongoing tensions within the labor market and the broader economic landscape, where mixed signals from job data complicate the Federal Reserve's decision-making process. While some indicators suggest stability, others raise concerns about inflation and the potential need for rate adjustments, creating a complex environment for policymakers.

— via World Pulse Now AI Editorial System