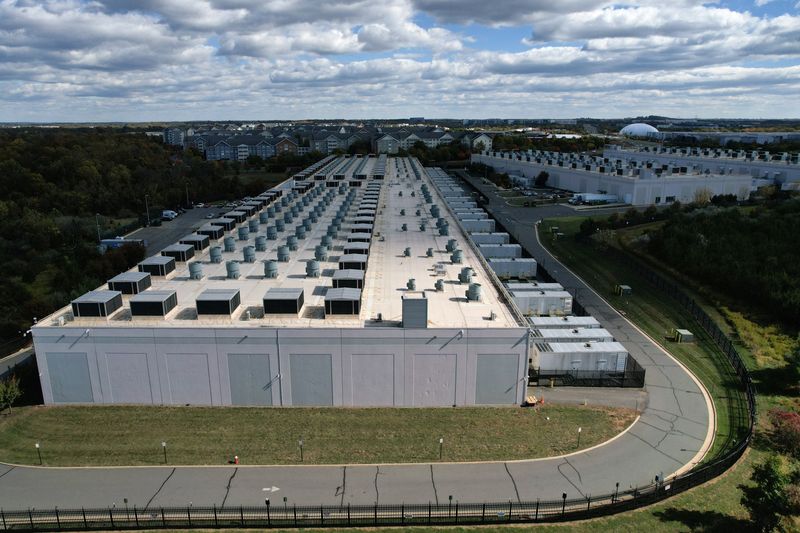

'Significant signs of recovery' hours after major internet outage

PositiveFinancial Markets

After a significant internet outage that affected thousands of websites, including major platforms like Amazon and Snapchat, signs of recovery are emerging. This is important as it highlights the resilience of internet infrastructure and the swift response from service providers to restore connectivity, ensuring that users can return to their online activities.

— Curated by the World Pulse Now AI Editorial System