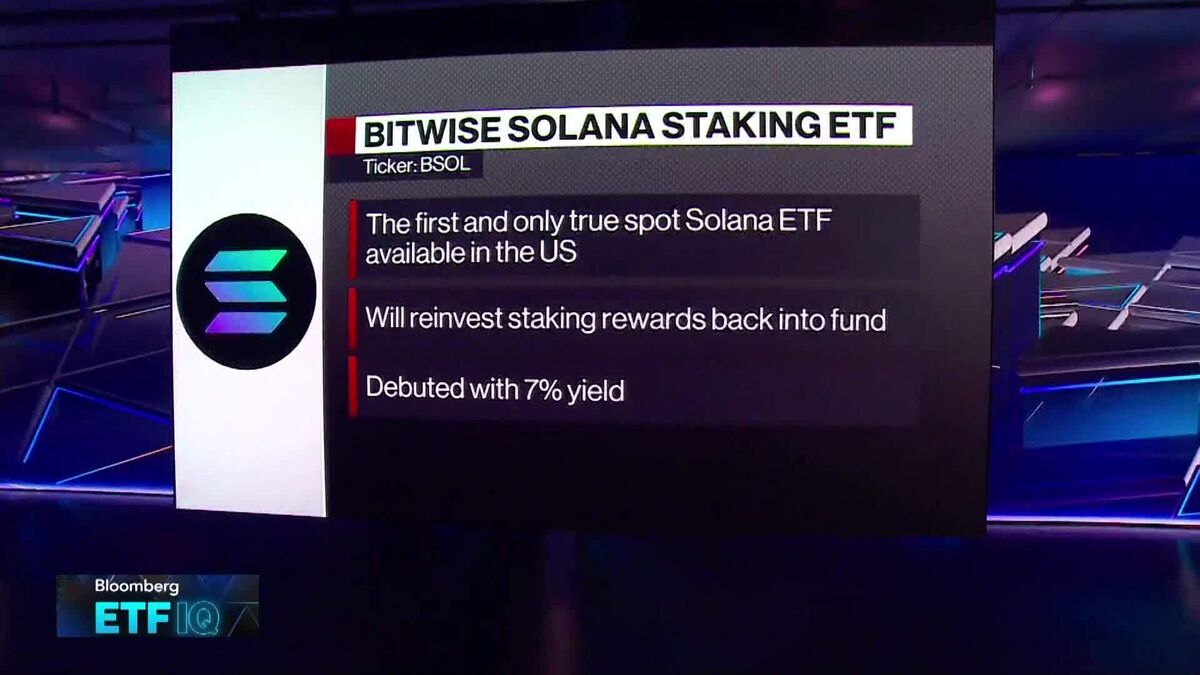

New Solana ETF Draws Strong Flows in Debut

PositiveFinancial Markets

The launch of the Bitwise Solana Staking ETF (BSOL) marks a significant milestone in the cryptocurrency market, as it is the first ETF to offer full staking exposure to Solana, the sixth-largest token. With an attractive yield of around 7%, this debut has attracted strong investor interest, highlighting a growing trend of smaller cryptocurrency ETFs entering Wall Street despite the ongoing government shutdown. This development is important as it reflects the increasing acceptance and integration of digital assets into traditional finance, potentially paving the way for more innovative investment products in the future.

— Curated by the World Pulse Now AI Editorial System