FTSE Russell upgrades Vietnam to emerging market status, pending interim review

PositiveFinancial Markets

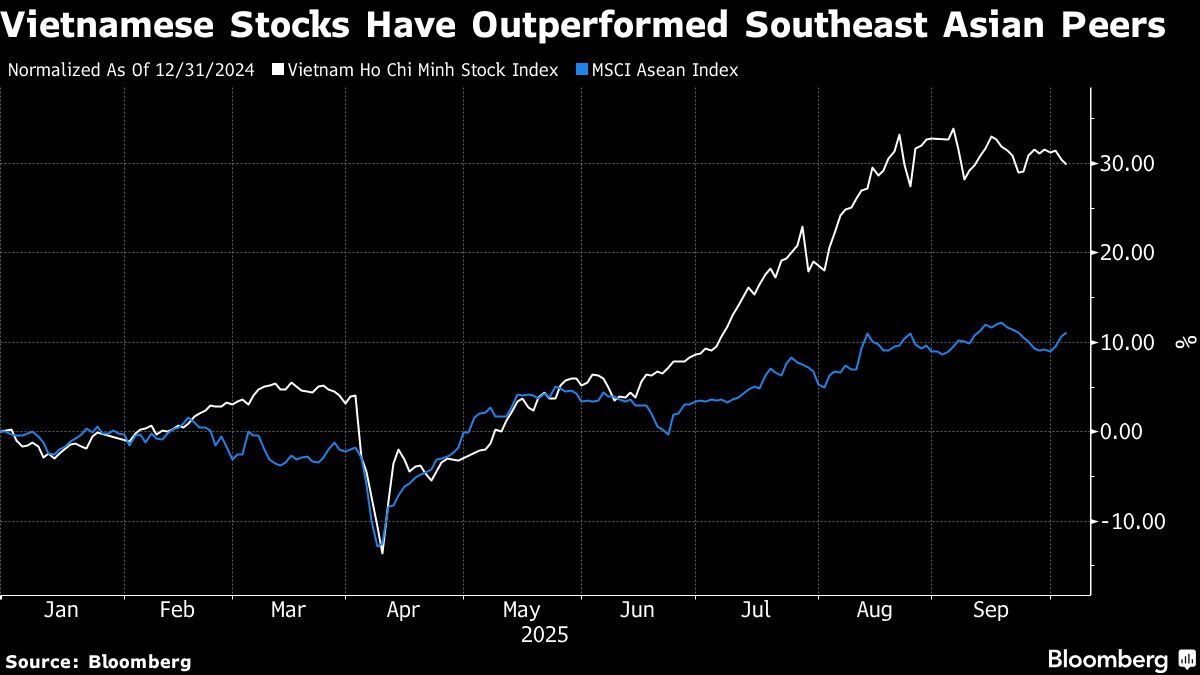

FTSE Russell has upgraded Vietnam to emerging market status, a significant recognition that could attract more foreign investment and boost the country's economic growth. This change reflects Vietnam's improving market conditions and potential for development, making it an appealing destination for investors looking for opportunities in Southeast Asia.

— Curated by the World Pulse Now AI Editorial System