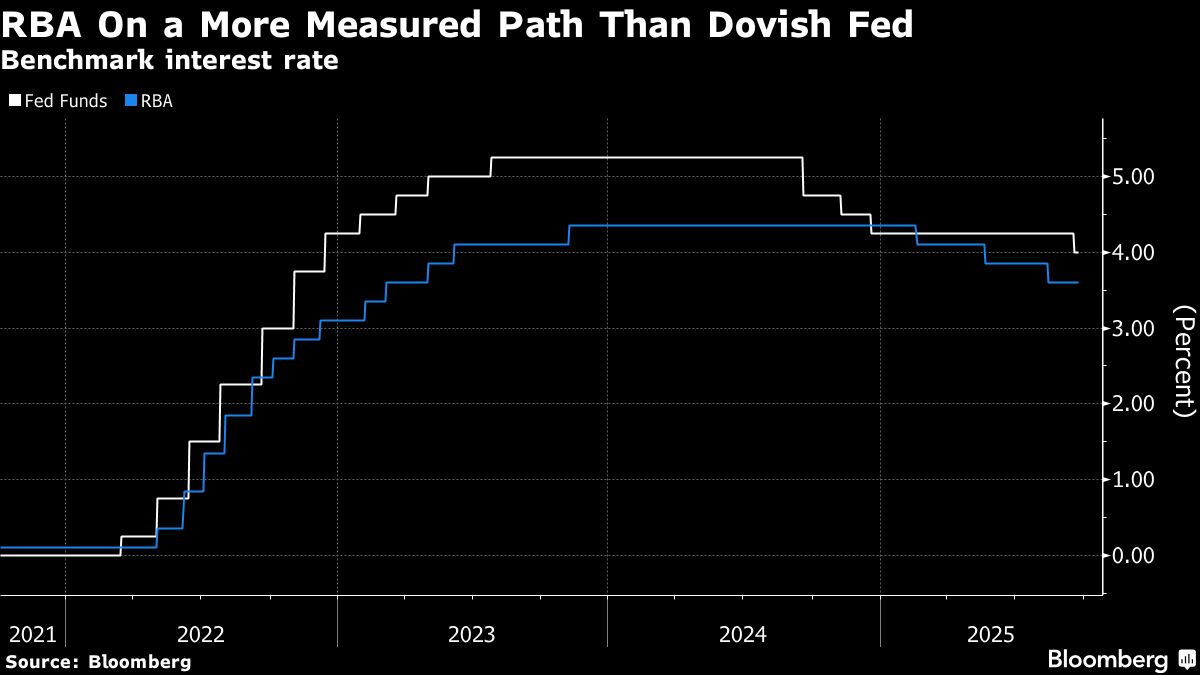

Aussie to Gain as Rates Set to Offer Premium Over Fed, AMP Says

PositiveFinancial Markets

Australia is poised to benefit as its interest rates are expected to surpass those of the US in the near future. This shift could enhance the attractiveness of Australian assets, leading to a stronger local dollar. AMP Ltd highlights this potential change, suggesting that investors may find more value in Australian investments as the rate gap widens, which is significant for the economy and currency stability.

— Curated by the World Pulse Now AI Editorial System