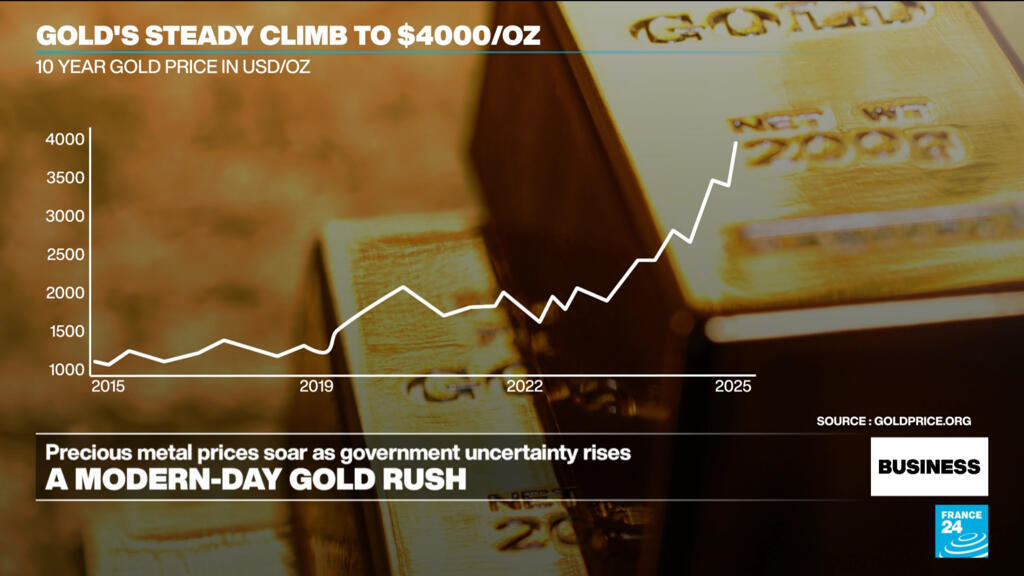

Gold soars above $4,000 an ounce; FOMC minutes ahead - what’s moving markets

PositiveFinancial Markets

Gold prices have surged above $4,000 an ounce, signaling a strong demand for the precious metal amid economic uncertainties. This rise is significant as it reflects investors' confidence in gold as a safe haven during turbulent times. With the FOMC minutes set to be released soon, market watchers are keen to see how monetary policy might influence future gold prices and overall market trends.

— Curated by the World Pulse Now AI Editorial System