Binance Increases Compensation for Customers Liquidated in Crypto Selloff

PositiveFinancial Markets

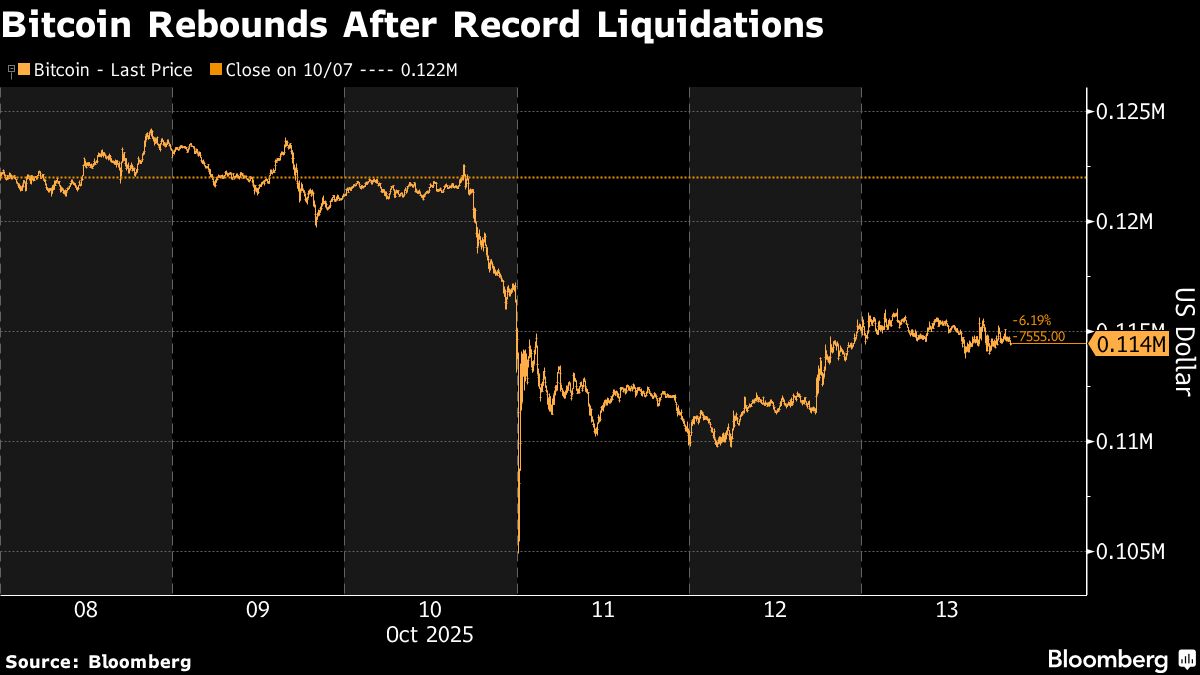

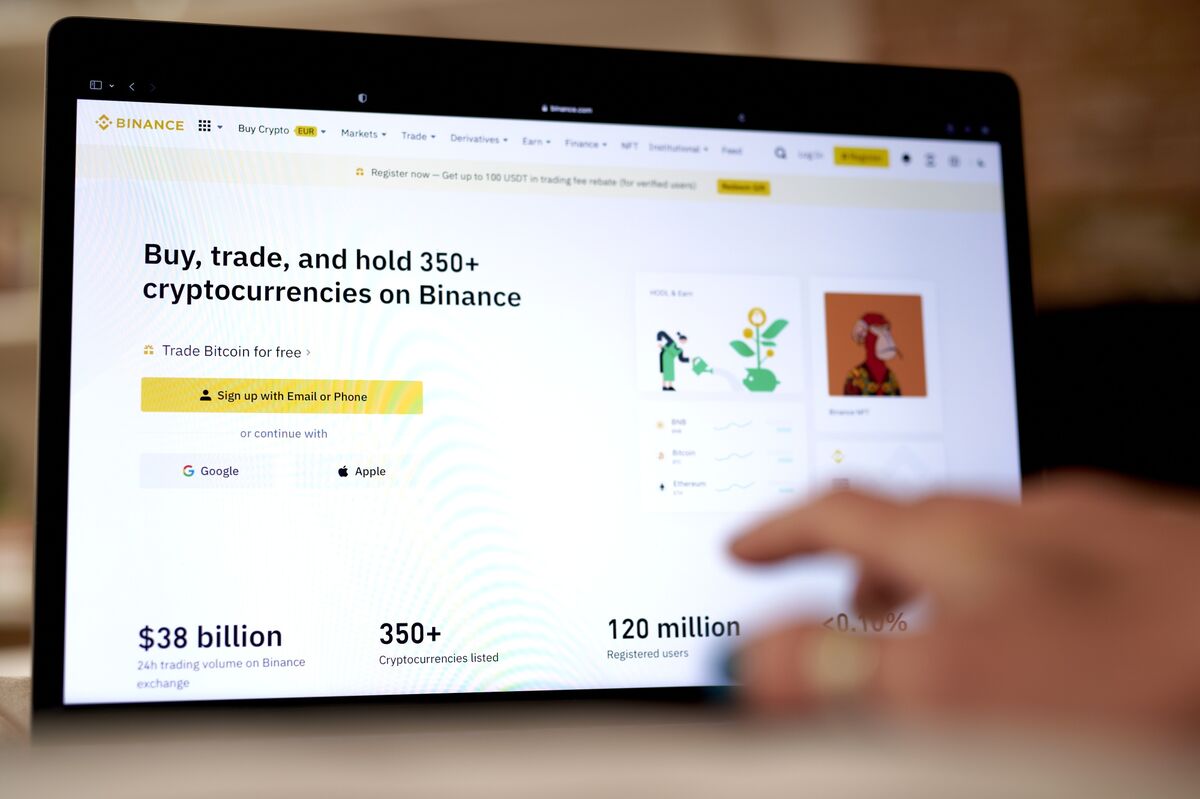

Binance is stepping up to support its users following the recent crypto selloff by announcing an additional $300 million in stablecoin compensation for those affected by forced liquidations. This move comes amid criticism of the exchange's role in the market crash, and it also includes $100 million in low-interest loans aimed at helping severely impacted institutions get back on their feet. This initiative not only aims to restore trust among users but also stabilizes the broader crypto market, highlighting Binance's commitment to its community.

— Curated by the World Pulse Now AI Editorial System