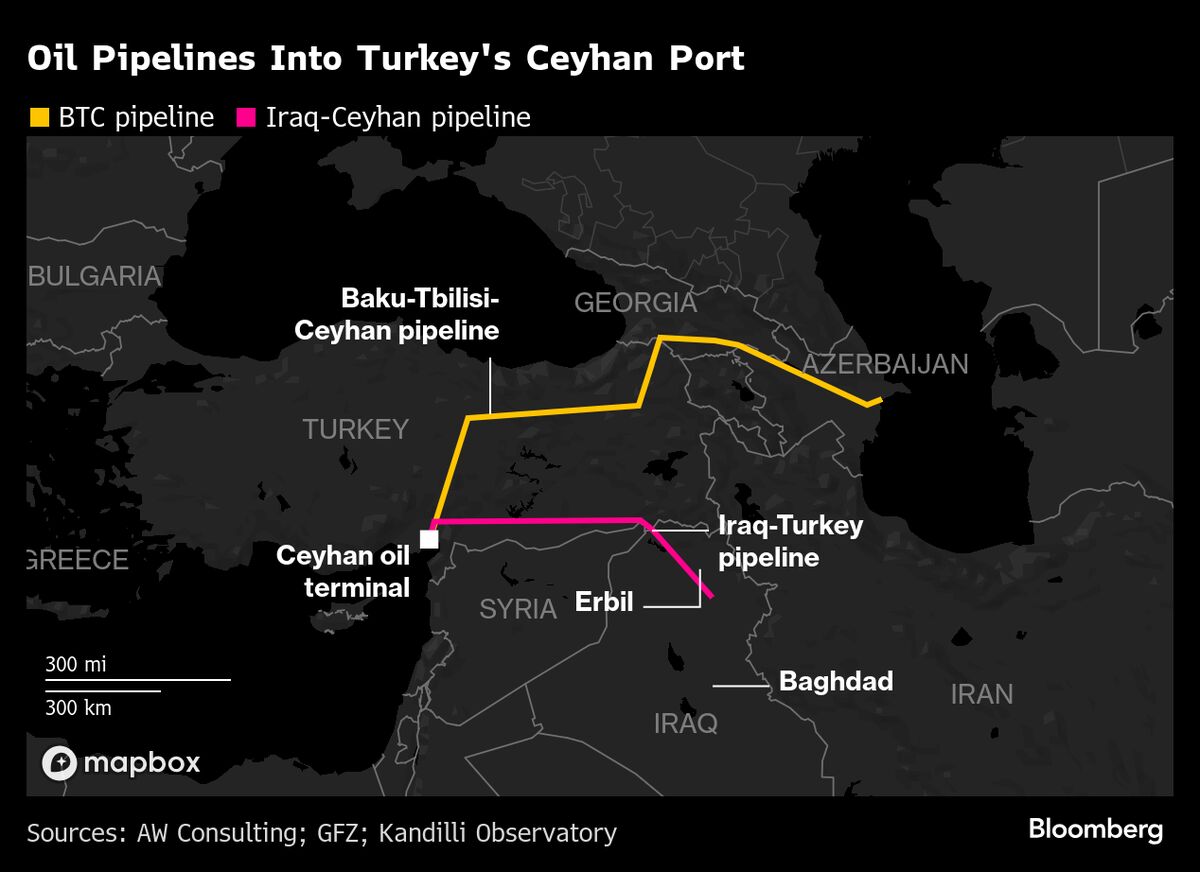

US Seeks to Make Kurdish Oil Exports Long-Lasting After Key Deal

PositiveFinancial Markets

The Trump administration is taking significant steps to ensure that oil exports from northern Iraq, which recently resumed after a two-year pause, continue in the long term. This move is crucial not only for bolstering Iraq's economy but also for providing opportunities for US companies and countering Iran's influence in the region. It's a strategic effort that highlights the importance of energy resources in international relations.

— Curated by the World Pulse Now AI Editorial System