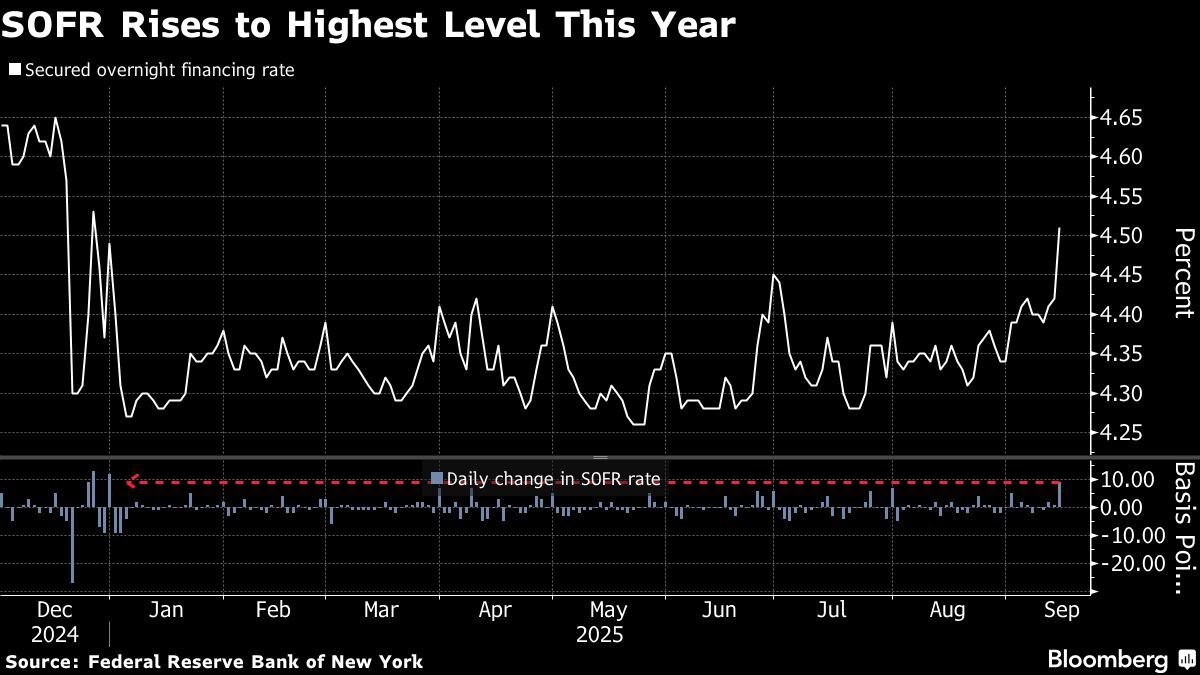

US Short-Term Rate Jumps, Signaling New Era of Funding Strains

NegativeFinancial Markets

This week, a crucial interest rate in the US financial system surged beyond the Federal Reserve's target range, highlighting growing funding strains due to reduced liquidity and upcoming financial obligations.

Editor’s Note: The rise in interest rates signals potential challenges for borrowers and the economy, as it reflects tightening financial conditions. Understanding these shifts is essential for businesses and consumers alike, as they may impact loans, investments, and overall economic stability.

— Curated by the World Pulse Now AI Editorial System