Third-Largest Stablecoin Briefly Loses Dollar Peg in Crypto Rout

NegativeFinancial Markets

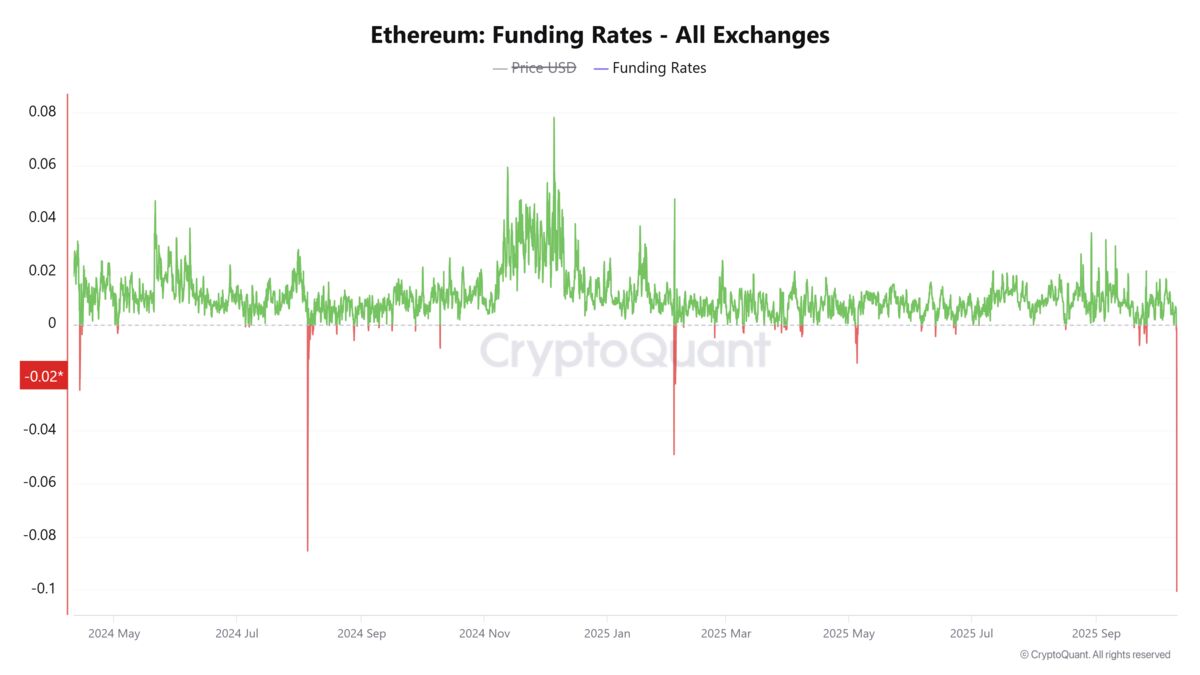

In a recent market downturn, Ethena's yield-bearing stablecoin briefly lost its dollar peg, highlighting the volatility in the cryptocurrency space. This incident is significant as it reflects the challenges stablecoins face in maintaining their value during turbulent market conditions, raising concerns among investors about the stability and reliability of such digital assets.

— Curated by the World Pulse Now AI Editorial System