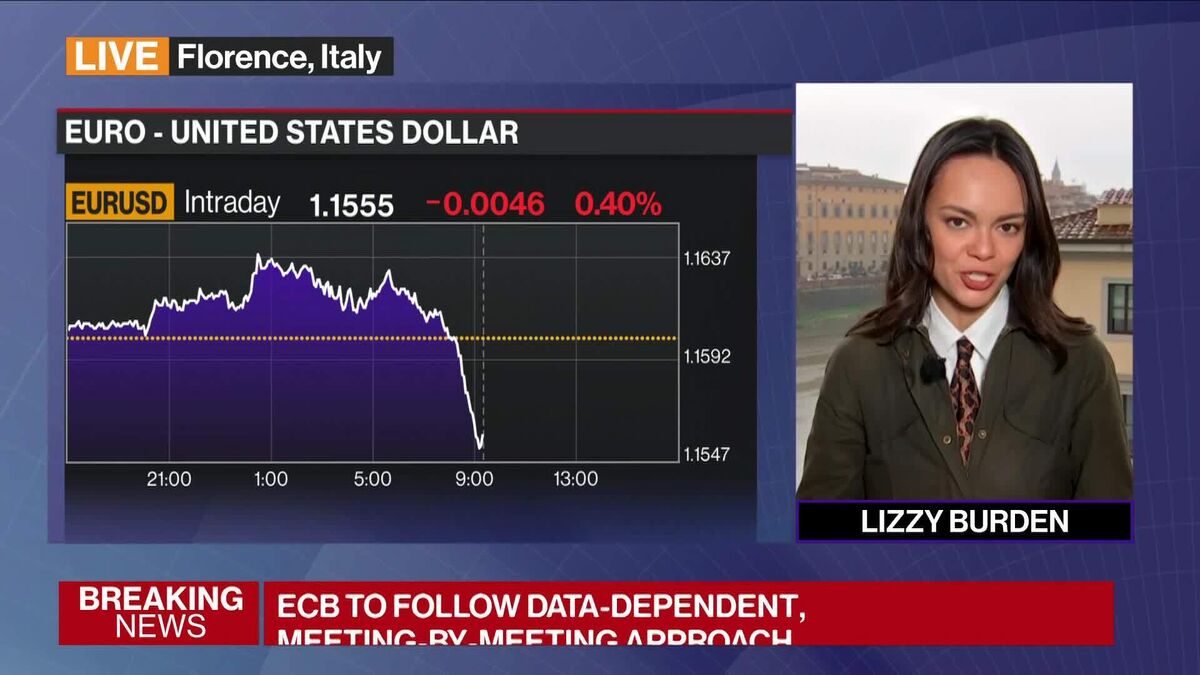

French Inflation Slows Further Below ECB Target on Energy, Food

PositiveFinancial Markets

In October, French inflation continued to decline, falling below the European Central Bank's target, thanks to a drop in energy costs and a slowdown in food-price increases. This is significant as it indicates a potential easing of financial pressures on consumers, which could lead to improved economic stability and consumer confidence in France.

— Curated by the World Pulse Now AI Editorial System