KKR's McVey Sees US Tariffs on China Coming Down 20%-30%

PositiveFinancial Markets

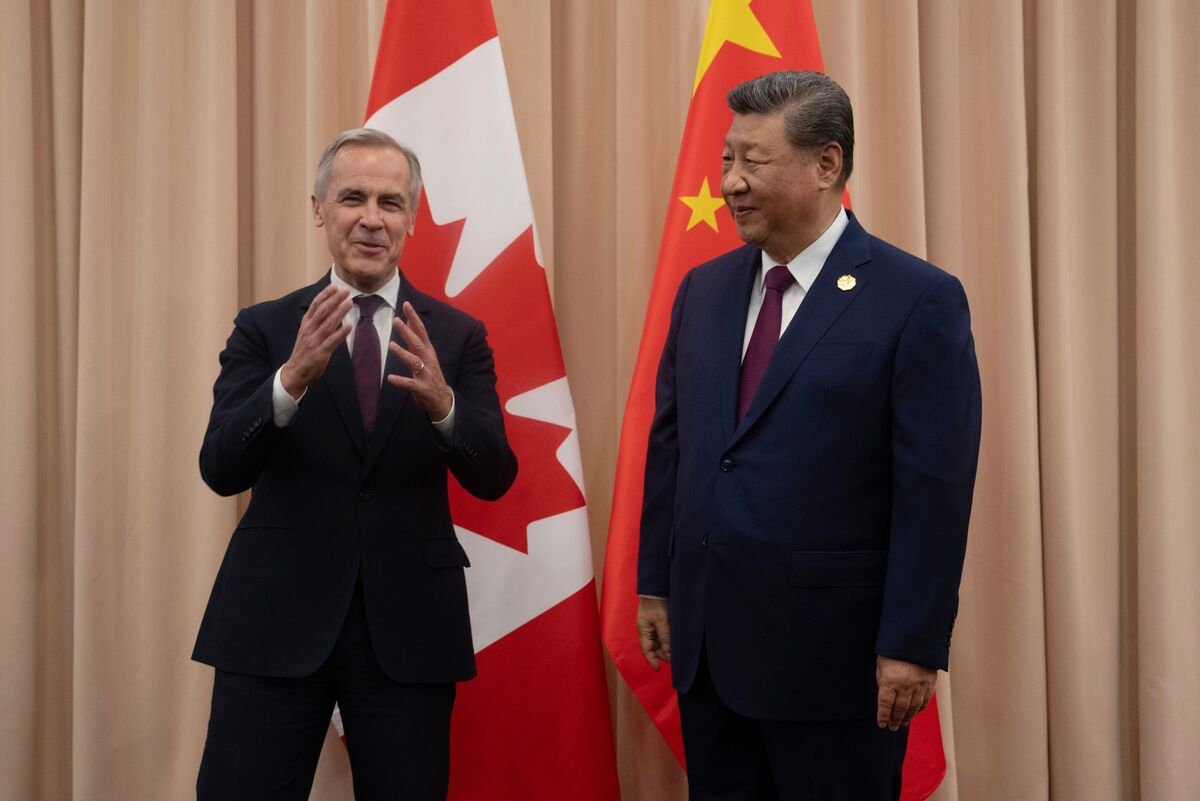

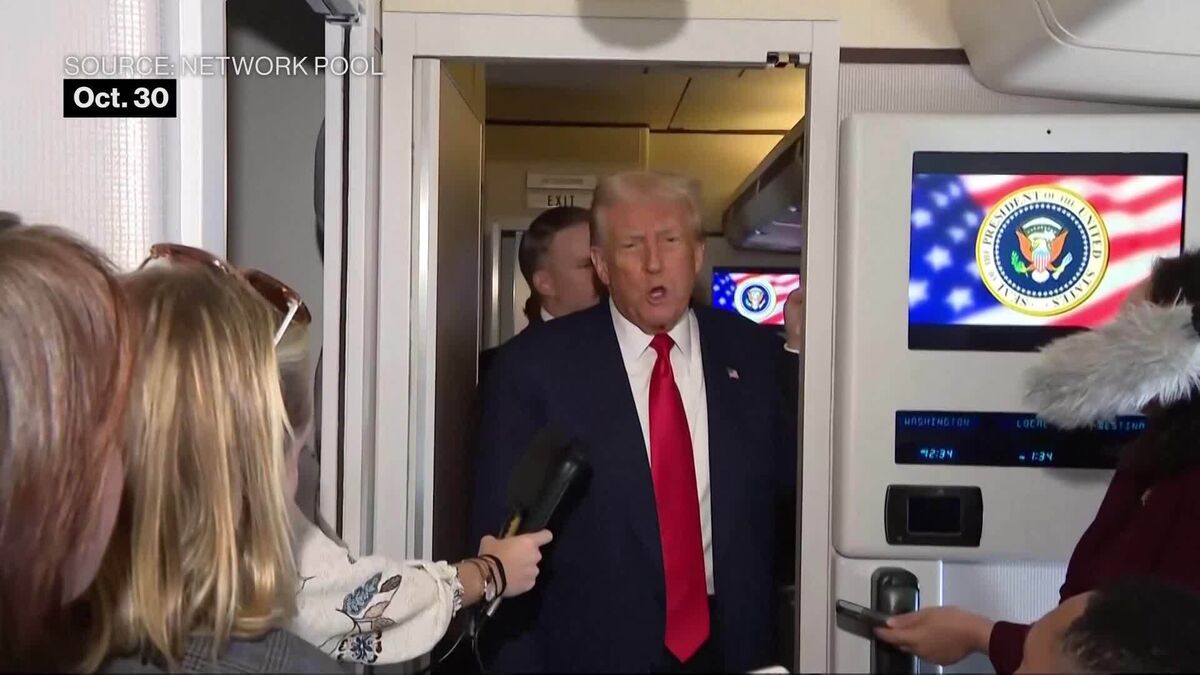

Henry McVey from KKR believes that the US and China are likely to reduce tariffs by 20%-30% as both nations recognize their interdependence. This insight comes ahead of a crucial meeting between President Trump and President Xi Jinping in Gyeongju, South Korea. Such a deal would not only ease trade tensions but also foster better economic relations, which is vital for global markets.

— Curated by the World Pulse Now AI Editorial System