Oil Steadies as Traders Weigh US Moves on Venezuela, Oversupply

NeutralFinancial Markets

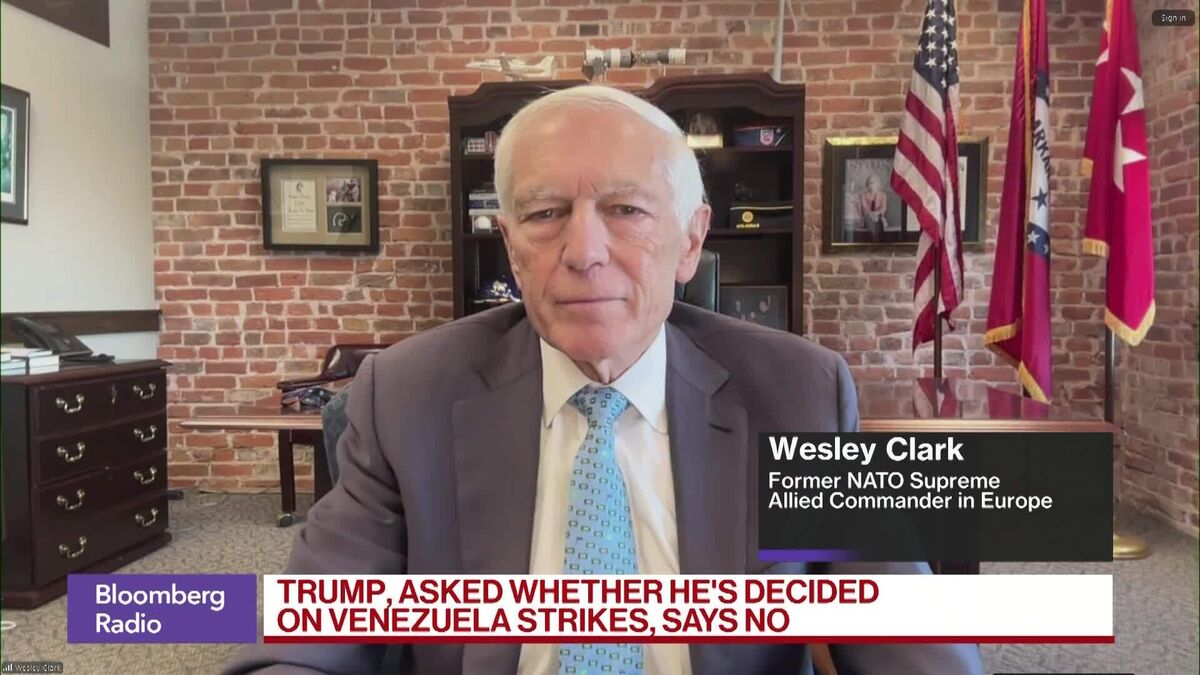

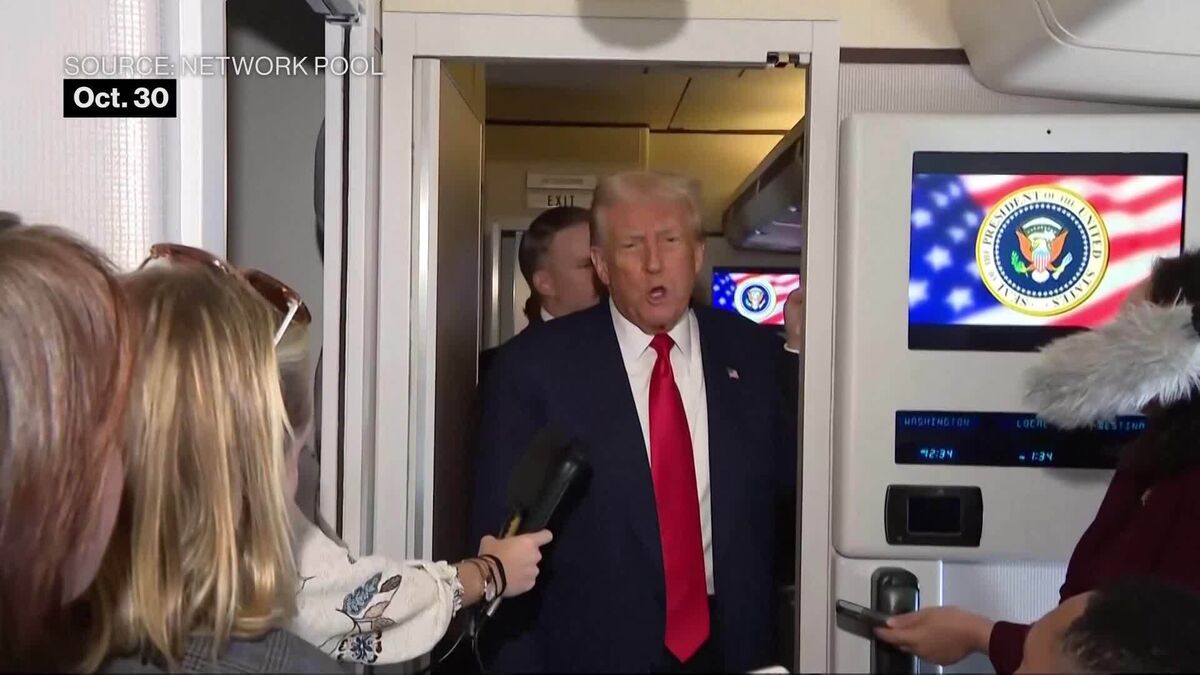

Oil prices stabilized as traders assessed the potential impact of US actions regarding Venezuela and OPEC+'s upcoming meeting. While there were earlier reports suggesting military strikes on Venezuela, President Trump has denied any such plans, which has contributed to a more cautious market sentiment. This situation is significant as it reflects the delicate balance between geopolitical tensions and oil supply dynamics, influencing global oil prices and market stability.

— Curated by the World Pulse Now AI Editorial System