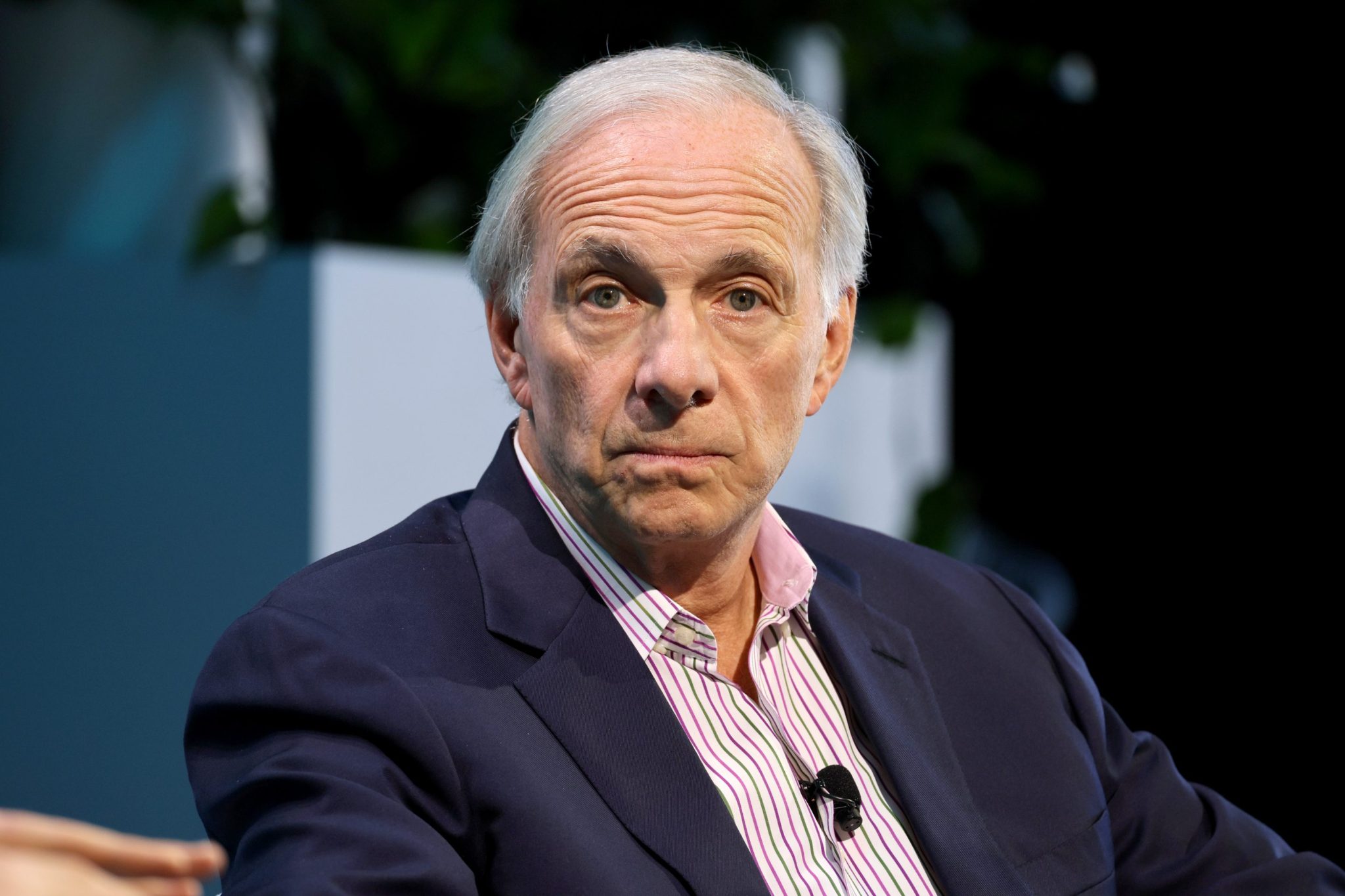

Nvidia turns negative after Ray Dalio warns the latest market boom is a ‘big bubble with big wealth gaps’ poised for a politically explosive bust

NegativeFinancial Markets

- Ray Dalio's warning about an impending market bubble has led to a negative sentiment surrounding Nvidia, suggesting that the company may be vulnerable to broader economic shifts.

- Nvidia's performance is critical as it plays a significant role in the tech sector, and any downturn could have ripple effects on investor confidence and market stability.

- The juxtaposition of Nvidia's strong earnings reports against fears of an AI bubble highlights ongoing tensions in the market, where optimism can quickly turn to concern amid economic uncertainties.

— via World Pulse Now AI Editorial System