Wall Street Extending Research into Private Companies

PositiveFinancial Markets

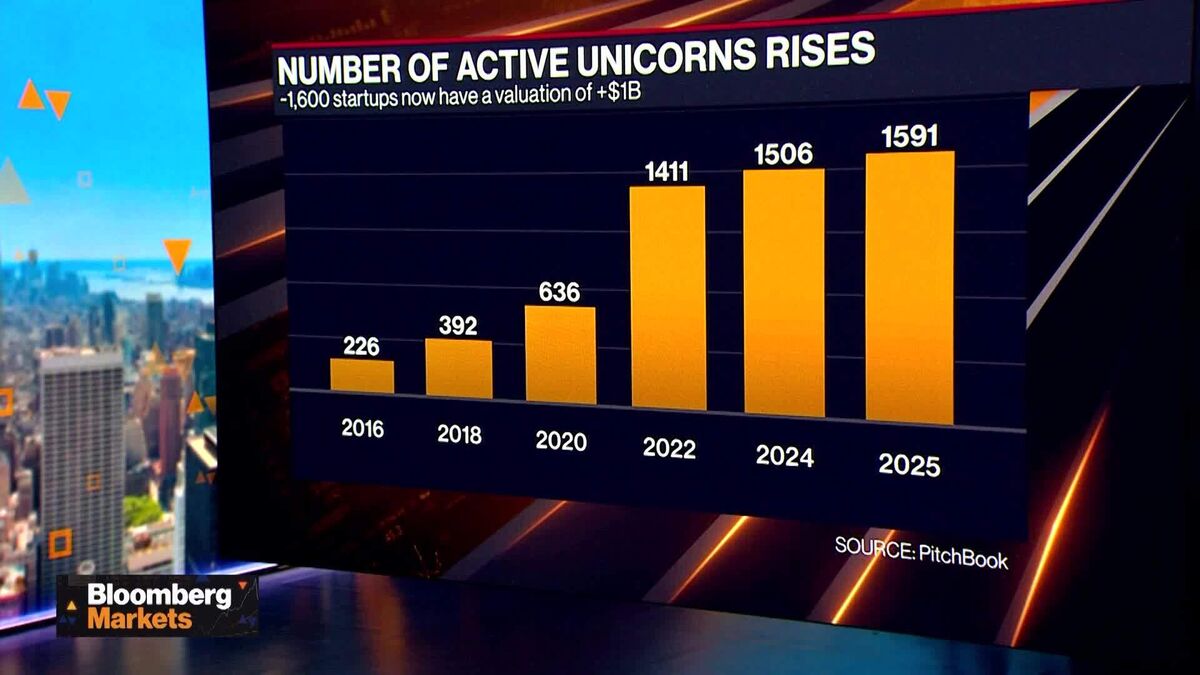

- Wall Street is broadening its equity research to include private companies, particularly in response to the growing prominence of firms like OpenAI. This strategic move reflects a recognition of the significant influence these private entities can have on market dynamics.

- The expansion of research into private assets is crucial for financial institutions as it allows them to stay competitive and informed about emerging technologies and trends that could reshape investment strategies and market valuations.

- This development occurs amid a broader surge in AI investments and spending, with Wall Street projecting substantial growth in the sector, highlighting the ongoing debate about the sustainability and implications of the AI boom.

— via World Pulse Now AI Editorial System