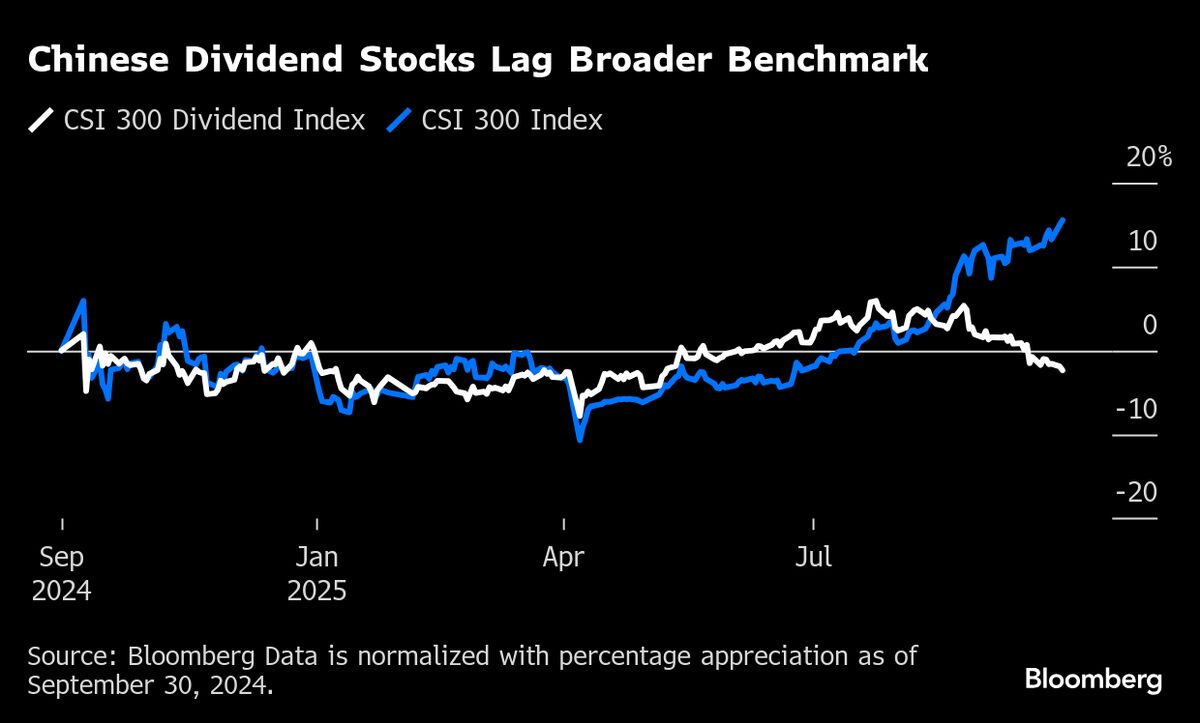

Amundi Eases China Bets, Eyes Safer Plays on Valuation Concern

NegativeFinancial Markets

Amundi SA has decided to reduce its exposure to China's recent equity rally, shifting its focus towards safer investments like dividend stocks. This move comes amid ongoing concerns about the economic outlook in China, highlighting the cautious approach investors are taking in response to market volatility. It matters because it reflects broader uncertainties in the global market and the need for investors to adapt their strategies to safeguard their portfolios.

— Curated by the World Pulse Now AI Editorial System