Tech leads Asia share rally, gold near record high on Fed rate cut bets

PositiveFinancial Markets

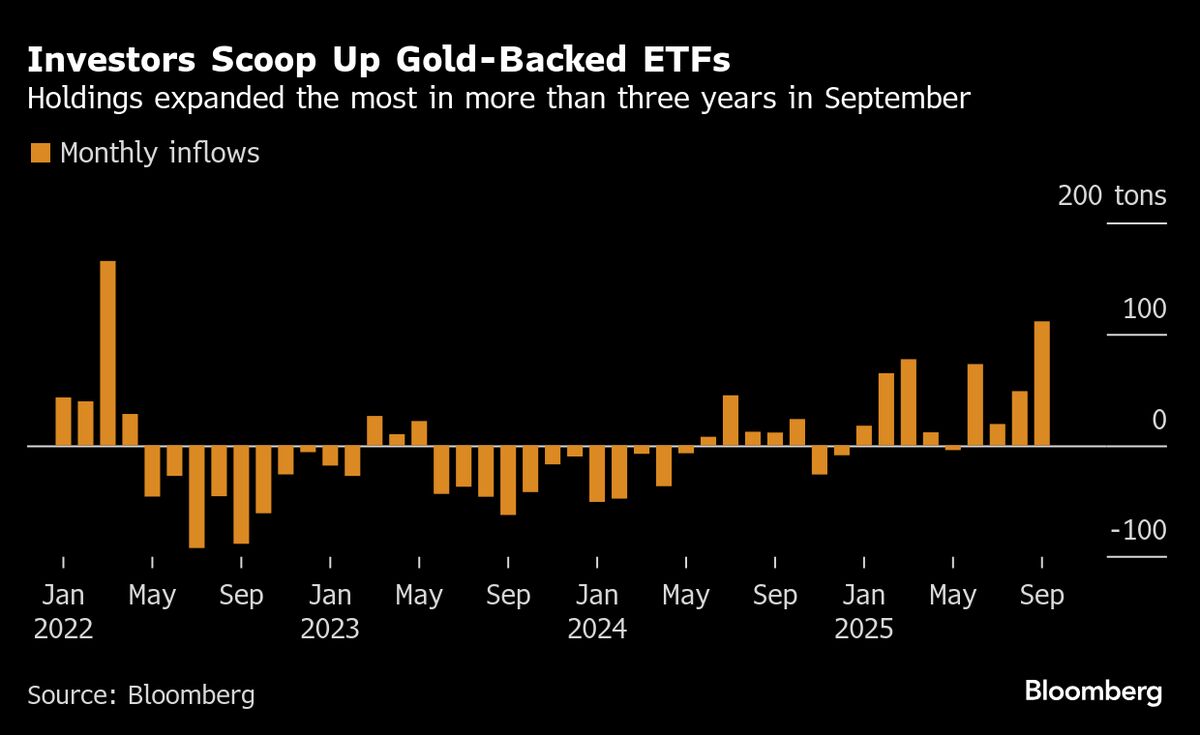

Asian markets are experiencing a significant rally, driven by optimism surrounding potential interest rate cuts by the Federal Reserve. This surge in tech stocks is not only boosting investor confidence but also pushing gold prices close to record highs, as investors seek safe-haven assets amid economic uncertainties. The interplay between tech growth and gold's stability highlights a dynamic shift in market sentiment, making it a crucial moment for investors to watch.

— Curated by the World Pulse Now AI Editorial System