Fed’s Bowman expects two more interest rate cuts this year

PositiveFinancial Markets

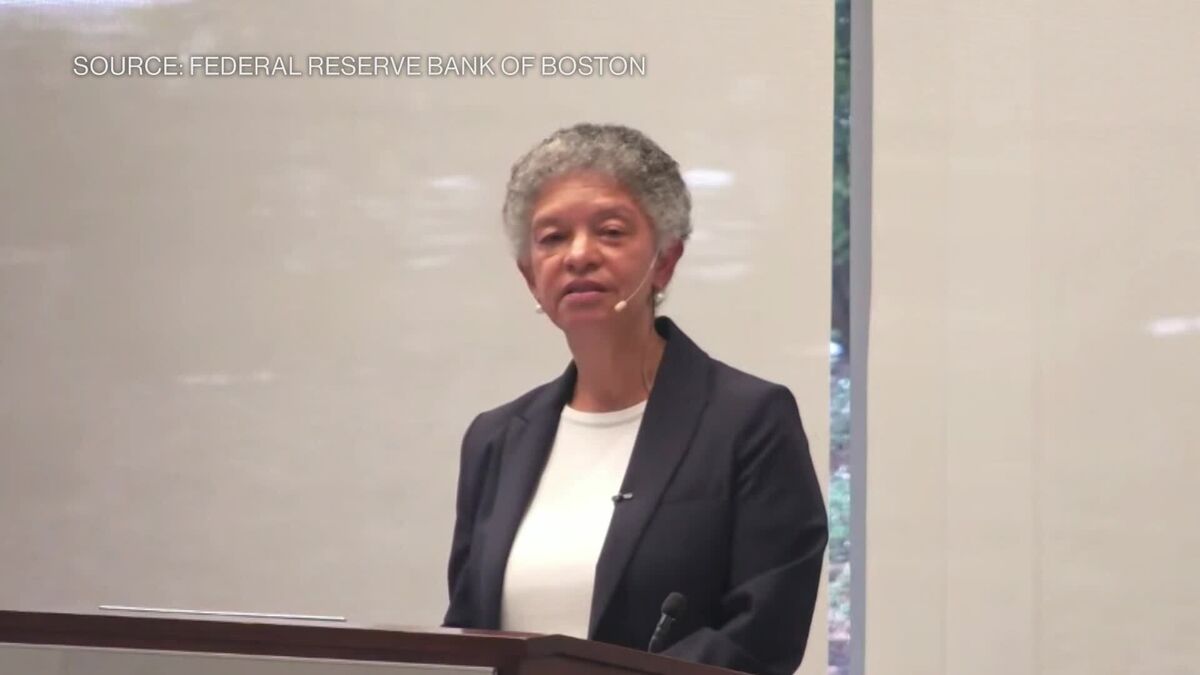

Federal Reserve Governor Michelle Bowman has indicated that she anticipates two more interest rate cuts this year, which could provide much-needed relief to borrowers and stimulate economic growth. This is significant as it reflects the Fed's response to ongoing inflation concerns and aims to support the economy's recovery. Lower interest rates can encourage spending and investment, making it a crucial development for both consumers and businesses.

— Curated by the World Pulse Now AI Editorial System