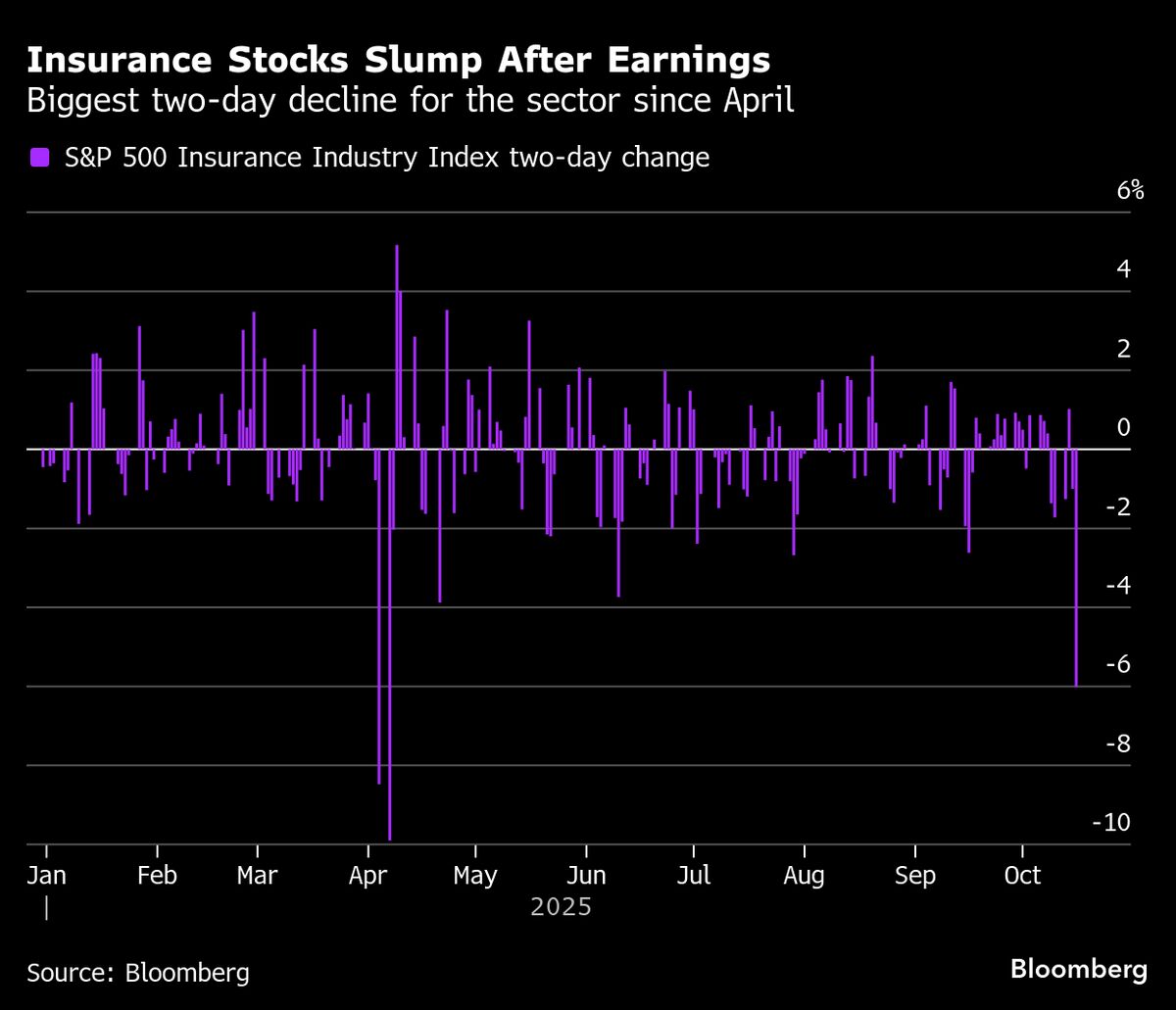

Insurance Stocks Extend Rout as Soft Earnings Spur Growth Fears

NegativeFinancial Markets

Insurance stocks are facing a tough time as shares of major companies like Marsh & McLennan, Progressive, and Travelers continue to decline following disappointing earnings reports. This downturn raises concerns about the overall growth potential of the insurance sector, which could have broader implications for the market and investors.

— Curated by the World Pulse Now AI Editorial System