Travelers Quarterly Profit Rises

PositiveFinancial Markets

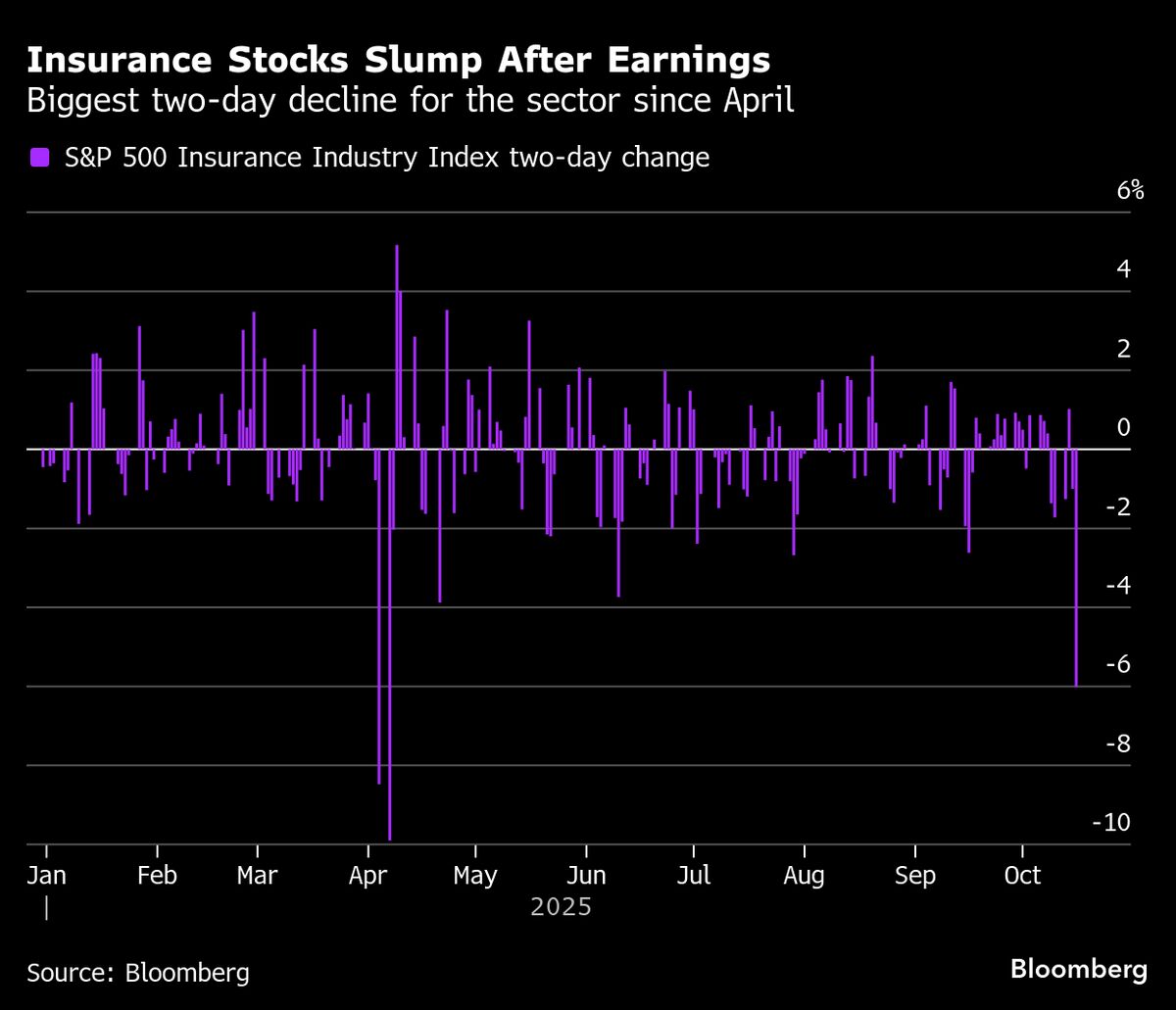

Travelers has reported a significant increase in profit for the third quarter, driven by a boost in revenue and net written premiums. This positive financial performance highlights the company's strong market position and effective strategies, making it a noteworthy development in the insurance sector.

— Curated by the World Pulse Now AI Editorial System