Asia Poised for a Weak Start After US Stocks Waver: Markets Wrap

NegativeFinancial Markets

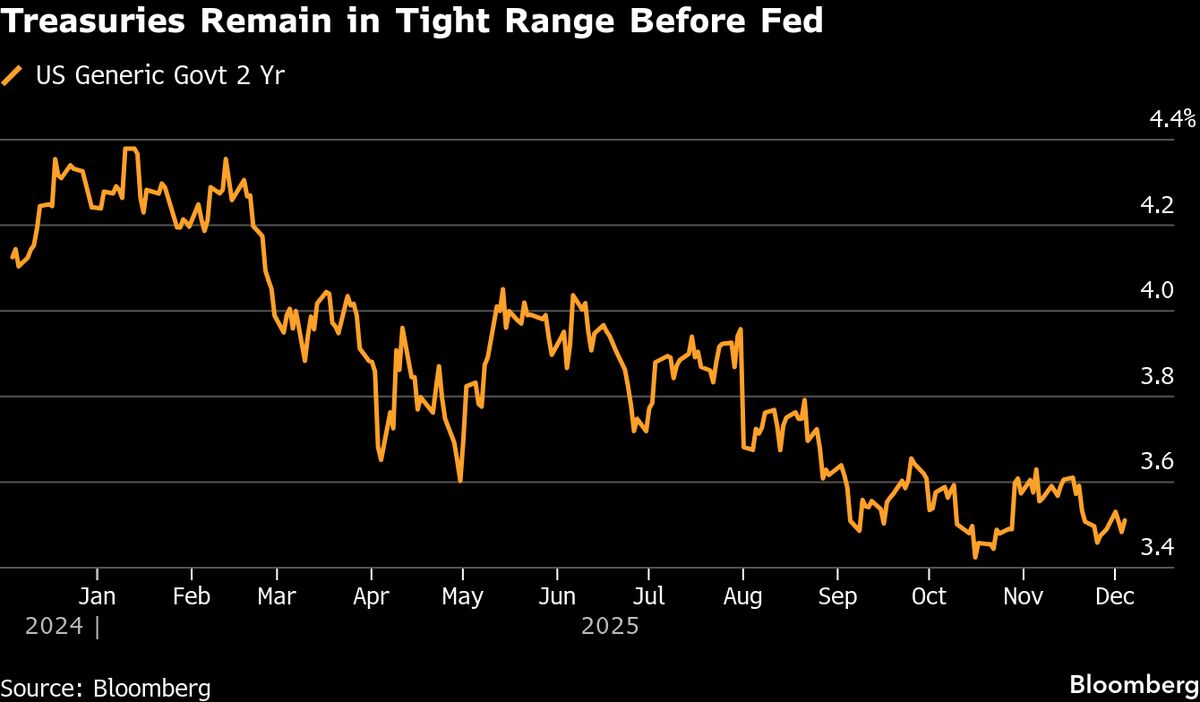

- Asian equities are expected to open weakly following a lackluster session on Wall Street, where tech stocks and bonds faced pressure, and Bitcoin's recovery stalled ahead of the Federal Reserve's upcoming decision on interest rates.

- This development is significant as it reflects the ongoing volatility in global markets, particularly in the tech sector, which has been sensitive to shifts in monetary policy and investor sentiment, impacting overall market confidence.

- The situation underscores a broader trend of fluctuating investor sentiment influenced by economic indicators and expectations of interest rate adjustments, as markets react to signs of a potential slowdown in the U.S. economy.

— via World Pulse Now AI Editorial System