For Wall Street, pandemic-level bad news for jobs is good news for stocks—it pushes the Fed further into cutting territory

PositiveFinancial Markets

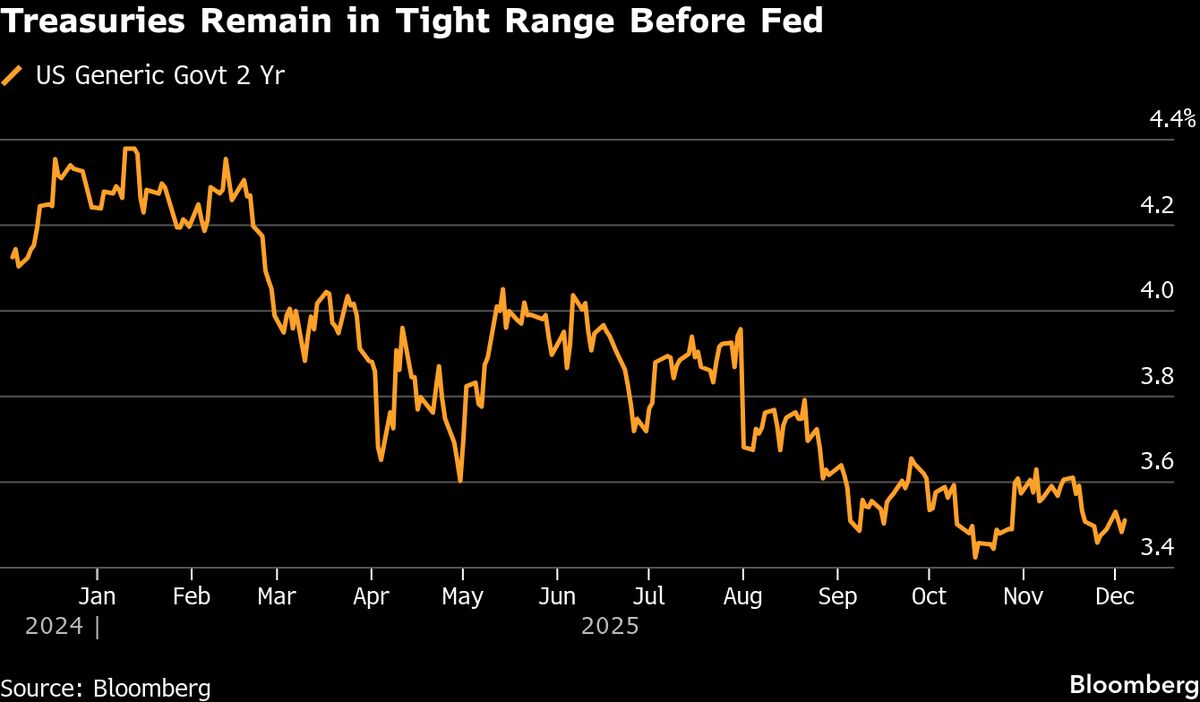

- Recent labor data has shown significant weakness, with ADP reporting job losses and Challenger announcing layoffs, leading to a surge in expectations for a Federal Reserve interest rate cut, now estimated at 90% for December. This situation reflects a paradox where bad news for jobs is perceived as good news for Wall Street, as it may prompt monetary easing.

- The anticipated rate cut is crucial for Wall Street as it could stimulate market activity and investor confidence, particularly in the technology sector, which has been recovering from recent volatility. A rate cut could lower borrowing costs and encourage spending.

- This development highlights a broader trend where economic indicators, particularly in the labor market, are influencing monetary policy decisions. The mixed signals from job data have left investors divided on the Fed's next steps, with some analysts expressing concern over the implications of a weakening labor market on overall economic health.

— via World Pulse Now AI Editorial System