How to Trade Amid US Shutdown, Jobs Data Delay

NegativeFinancial Markets

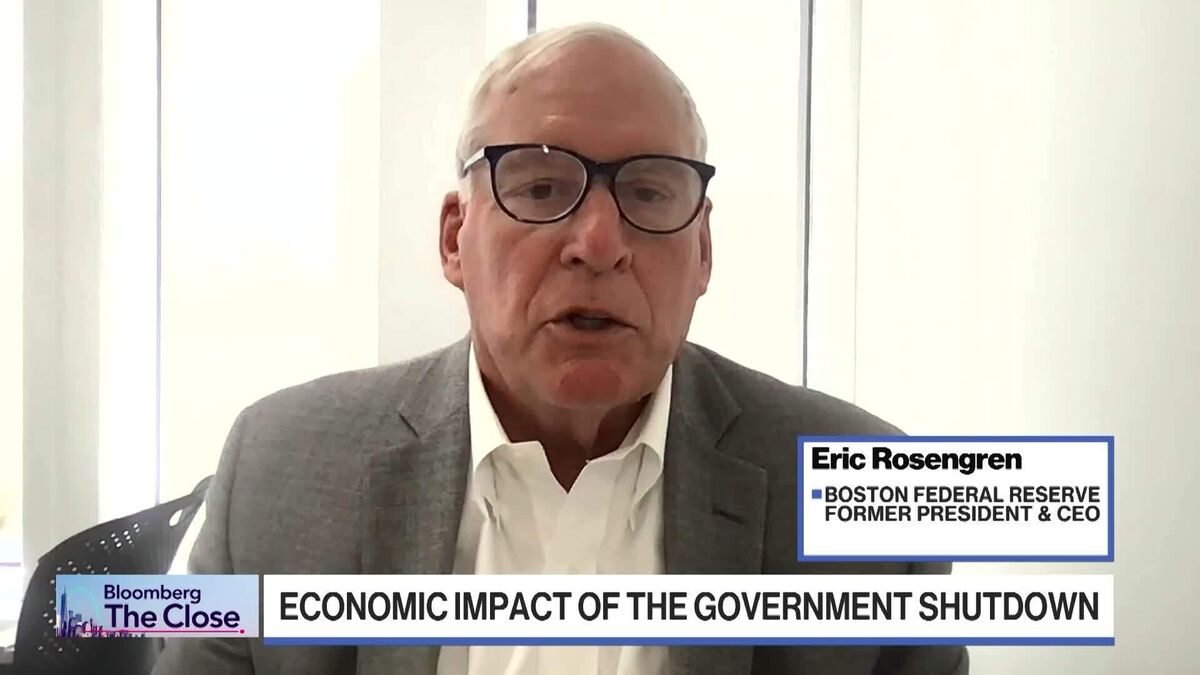

The ongoing US government shutdown is causing delays in the Bureau of Labor Statistics' release of nonfarm payrolls data, which is crucial for traders and economists. Seema Shah, chief global strategist at Principal Asset Management, highlighted the challenges this poses for market navigation, emphasizing that the absence of timely data complicates decision-making for traders and central bankers alike. This situation underscores the broader implications of political gridlock on economic indicators and market stability.

— Curated by the World Pulse Now AI Editorial System