Dollar Trades Steady as U.S. Government Shutdown Continues

NeutralFinancial Markets

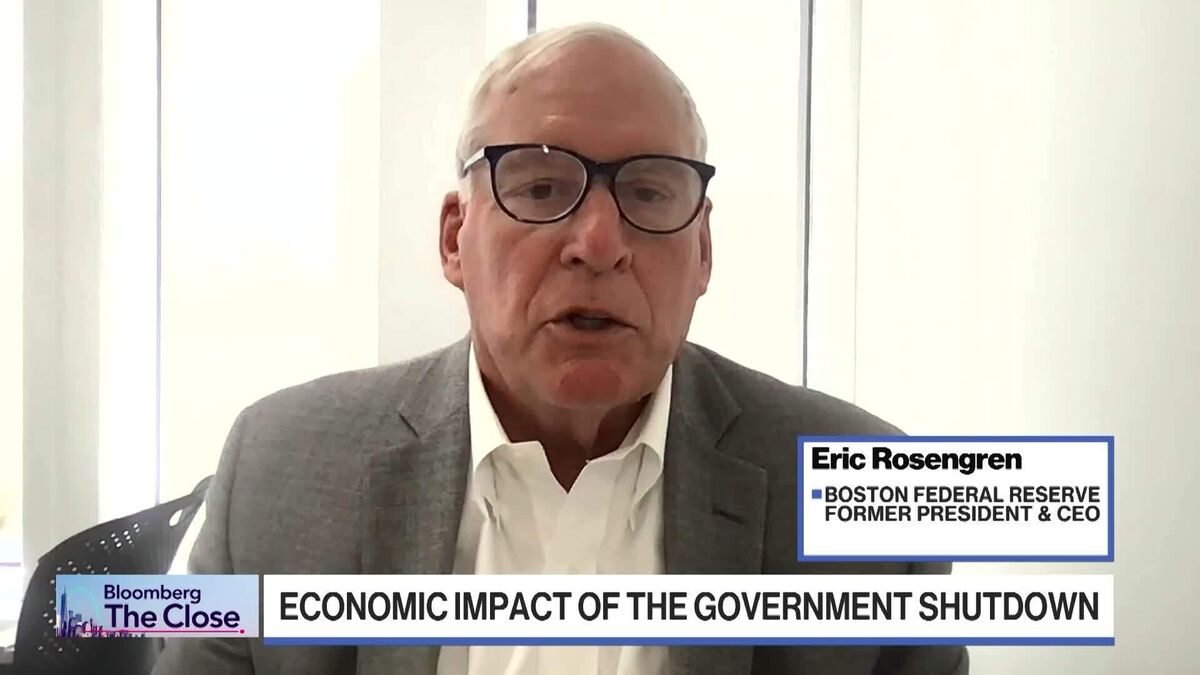

The dollar remains steady amidst the ongoing U.S. government shutdown, which has delayed the release of the important nonfarm payrolls report. This situation is significant as it highlights the impact of political decisions on economic indicators, affecting market confidence and financial planning.

— Curated by the World Pulse Now AI Editorial System